Building a multi-unit rental property in Nova Scotia is a big investment, and a new home warranty can protect you from unexpected construction issues. Here’s what you need to know:

- Deposit Protection: Safeguards your construction deposit if the builder defaults or abandons the project.

- Material and Workmanship Defects: Covers issues like faulty plumbing, electrical work, or poor-quality materials for the first year.

- Structural Problems: Provides up to 7 years of coverage for major structural defects like foundation or framing issues.

- Water Damage and Building Envelope: Protects against leaks and moisture-related issues for 2 years.

- Exclusions: Normal wear and tear, owner renovations, extreme weather damage, and lost rental income are not covered.

Choosing a builder with an integrated design-build approach ensures stronger warranty coverage, fewer delays, and clear accountability. Multi-unit property owners benefit not just from reduced repair costs but also from improved tenant satisfaction and steady rental income. Investing in the right warranty is essential to protect your property and peace of mind.

My 10 Essential Questions for Home Builders Changed Everything

What New Home Warranties Cover

New home warranties in Nova Scotia are designed to protect the vital aspects of your investment. They serve as a safeguard for your multi-unit rental property, covering specific risks that could arise during and after construction. Each component of the warranty plays a role in creating a safety net for your property.

Deposit Protection

One of the most critical elements of a new home warranty is deposit protection. For multi-unit buildings with 4–12 units, construction deposits can amount to hundreds of thousands of dollars. If the builder defaults or abandons the project, the warranty ensures your deposits are protected. This coverage provides financial security during the early stages of your project, typically up to specified limits, so you don’t risk losing your entire investment.

Beyond deposits, warranties also address issues with materials and workmanship to prevent costly problems down the line.

Material and Workmanship Defects

In the first year, the warranty focuses on material and workmanship defects. These include issues like faulty plumbing, electrical problems, improperly installed flooring, or defective appliances and fixtures. For multi-unit properties, such defects can become especially expensive if they affect multiple units at once.

Workmanship defects might involve poorly installed windows, doors, cabinetry, or interior finishes that fail to meet building codes or manufacturer standards. On the other hand, material defects cover cases where low-quality materials were used, or materials fail prematurely due to manufacturing flaws. Examples include roofing that wears out too quickly, defective siding, or flooring that deteriorates within months.

Major Structural Problems

Structural defects are among the most serious concerns for property owners. The warranty provides coverage for seven years for structural issues that could compromise the building's integrity.

This includes problems such as significant foundation settling that leads to large cracks, structural framing issues that jeopardize the building's stability, or load-bearing elements that fail to meet engineering requirements. For multi-unit properties, these defects can be particularly damaging, as they can impact the entire building and all the units within it.

Structural issues often take time to appear. For instance, foundation problems might not become evident until years after construction when the building’s settling patterns reveal underlying flaws. The extended coverage period accounts for this delayed onset.

Water Damage and Building Envelope Issues

The warranty also provides two years of protection for building envelope problems, which are among the most frequent issues in new construction. The building envelope includes all the exterior components that shield the interior from the elements - such as walls, roofs, windows, doors, and weatherproofing systems.

Water infiltration is a major concern. Covered issues include leaks caused by improperly sealed windows, roof leaks due to installation errors, and moisture problems stemming from inadequate vapour barriers or ventilation systems. These issues can lead to mould, tenant complaints, and higher maintenance costs if not addressed quickly.

What's Not Covered

Equally important is understanding what the warranty does not cover. Normal wear and tear - like faded paint, minor cracks, or general deterioration - is excluded. Similarly, any damage resulting from owner renovations, improper maintenance, or changes to mechanical systems won’t be covered. For instance, if you modify a unit or upgrade its systems, any resulting problems fall outside the warranty’s scope.

External factors like extreme weather events, flooding from external sources, or natural ground movement unrelated to construction defects are also excluded. Additionally, landscaping and site work typically have little to no coverage, and cosmetic imperfections - such as slight colour differences in materials or tiny blemishes in finishes - are generally not included.

Another key exclusion is consequential damages, such as lost rental income if tenants need to be relocated for repairs. While the warranty will cover the cost of fixing eligible defects, it won’t compensate for indirect losses. These exclusions highlight the importance of having clear contract terms and maintaining the property proactively to minimize risks.

Why Warranties Matter for Multi-Unit Property Owners

If you own a multi-unit rental property, warranties can be a game-changer. They don’t just protect your finances - they simplify operations and help you handle repairs in a way that keeps tenants happy. Let’s break down how warranties can help reduce repair costs, ease your stress, and improve tenant satisfaction.

Protection from Unexpected Repair Costs

Multi-unit buildings are complex, and when something goes wrong, it often affects more than one unit. Without a warranty, the costs for simultaneous repairs can hit your cash flow hard. With warranty coverage, these expenses are managed in a centralized way, helping you protect your investment and maintain steady returns.

Another common challenge in multi-unit properties is dealing with fragmented construction, which can lead to disputes and delays when repairs are needed. A warranty simplifies this process by streamlining accountability. Instead of chasing multiple contractors, you have one clear point of contact, making repairs faster and less complicated.

Peace of Mind for Property Owners

Managing repairs across multiple units can be overwhelming, especially when you’re dealing with several contractors and fragmented warranties. A comprehensive warranty eliminates this hassle by providing single-point accountability. If something goes wrong, you know exactly who to call - no guesswork, no finger-pointing.

This clarity is especially helpful for first-time multi-unit property owners. Managing a rental property comes with its fair share of challenges, but knowing that repair issues will be handled promptly can make the process far less stressful. It allows you to focus on what really matters: your tenants.

Better Tenant Satisfaction and Retention

Happy tenants are more likely to renew their leases, and warranties can play a big role in keeping them satisfied. Quick and efficient repairs mean fewer disruptions to their daily lives, creating a sense of security and trust in their living environment. When issues are resolved promptly, minor inconveniences don’t have a chance to escalate into major frustrations.

As the First American Home Care Buzz team puts it:

"Tenants appreciate a landlord who is responsive to their needs. As a landlord, having a home warranty in place allows you to address covered repairs. This can provide tenants with a sense of security and peace of mind, contributing to tenant satisfaction and retention." [1]

Another bonus? Many warranties include pre-screened technicians, which means repairs are handled by qualified professionals. This not only minimizes disruption for your tenants but also enhances your reputation as a reliable landlord. In the long run, this can make your property more appealing to prospective renters.

sbb-itb-16b8a48

Fragmented Construction vs. Integrated Design-Build: Warranty Differences

When building multi-unit rental properties in Nova Scotia, the construction method you choose has a direct impact on your warranty coverage and overall protection. Fragmented construction often leaves property owners vulnerable to disputes and gaps in coverage, while an integrated design-build approach offers clearer accountability and stronger warranty assurances.

Single Point of Accountability

One of the most striking differences between these two approaches is who stands behind the warranty. Fragmented construction involves managing multiple parties, each with its own warranties and responsibilities. If something goes wrong, this can result in a frustrating cycle of blame-shifting, leaving you unsure of who should handle repairs.

Kevin Reed, Owner and President of Bluestone Construction, highlights the importance of having direct accountability:

"The key distinction is that a builder's warranty is a direct promise from the company that built your home, which is the guarantee of accountability you want. The best new construction home warranty is backed by your builder. At Bluestone Construction our team has the confidence that we build homes that won't have issues. In other words, a builder's warranty should stand behind the company's work." [2]

With integrated design-build companies, the entire project is handled under one roof. This means there’s a single point of contact and a straightforward path to resolving any issues. This streamlined accountability is particularly valuable in multi-unit properties, where problems can affect multiple tenants at once.

Fixed Pricing and Timeline Guarantees

Integrated design-build firms also bring clarity to pricing and timelines. These companies often provide fixed-price contracts with guaranteed timelines, reflecting rigorous quality control that reduces the likelihood of defects. On the other hand, fragmented construction often operates on cost-plus models, where delays and budget overruns can lead to rushed work and compromises on quality.

Quality Control Systems

The quality of warranty coverage often mirrors the builder’s confidence in their work. Integrated design-build firms oversee every aspect of the project, employing skilled tradespeople, prioritizing details like sealing and water management, and using durable materials. In contrast, fragmented construction can involve contractors who may cut corners to meet tight deadlines or budget restrictions [2].

For property owners, these integrated practices result in dependable warranty coverage and fewer unexpected issues. Choosing an integrated design-build approach not only simplifies the construction process but also provides peace of mind with enhanced warranty protection that safeguards your investment.

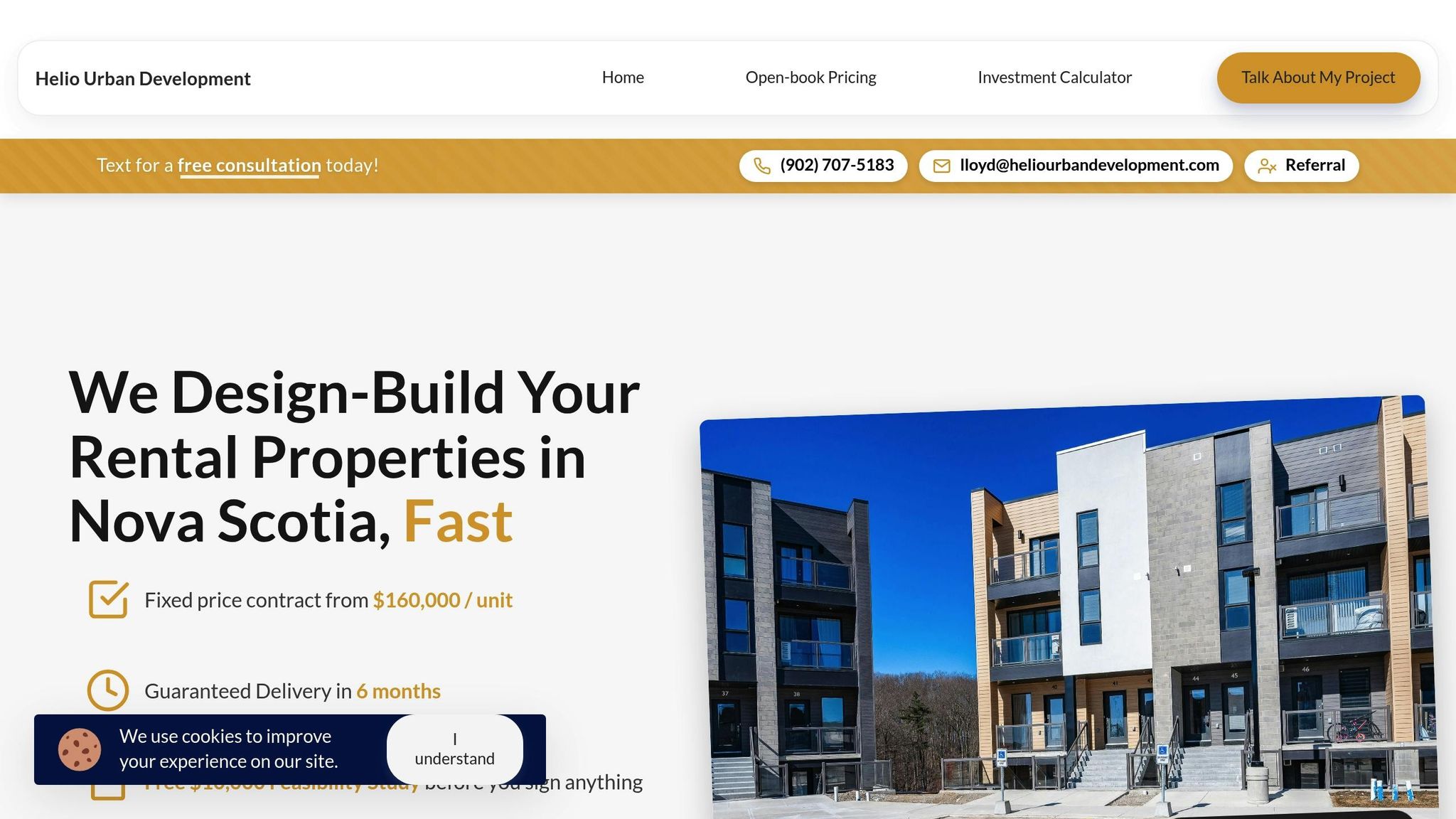

How Helio Urban Development Supports Warranty Protection

Helio Urban Development takes a unique approach to construction by combining design and build processes under one roof. This streamlined method ensures there are no gaps in warranty coverage, offering multi-unit investors a clear point of accountability throughout the project.

2-Year Construction Warranty

Helio provides a 2-year warranty that covers materials and workmanship, from the foundation to the finishing touches. This is particularly important for multi-unit rental properties, where a problem in one unit could easily affect others, disrupting tenants and cutting into rental income. With Helio’s approach, property owners always know exactly who to contact if warranty issues arise - no runaround, just solutions.

Fixed-Price, Guaranteed-Timeline Construction

Helio offers fixed-price contracts starting at $160,000 per unit, eliminating the uncertainty that often comes with construction budgets. As co-founder and CEO Lloyd Liu puts it:

"I personally review every quote and guarantee every timeline." [3]

This fixed price covers everything - design, materials, labour, permits, project management, and quality control. Helio also guarantees the timeline, offering a 6-month construction guarantee with compensation of up to $1,000 per day for delays. Unlike traditional construction methods, which often see cost overruns of up to 30% due to poor coordination, Helio’s integrated process ensures projects stay on track and on budget. This approach protects your investment from unexpected delays and escalating costs. [3]

Daily Updates and Project Documentation

Transparency is a cornerstone of Helio’s process. They provide daily photo updates and access to a real-time project portal, keeping property owners informed every step of the way. Co-founder and CTO Yuan He highlights the importance of their technology:

"Our AI scheduling system prevents the delays that killed our first project." [3]

This level of documentation not only keeps you in the loop but also simplifies warranty claims, ensuring you have all the information you need when it matters most.

Protecting Your Investment with the Right Warranty

Investing in a multi-unit rental property is a major financial commitment, especially in Nova Scotia's rental market, where quality 2-bedroom units can bring in $1,950 to $2,100 per month. Safeguarding that investment with the right warranty coverage isn’t just a good idea - it’s a necessity.

The way your property is constructed plays a big role in how well your investment is protected. Fragmented construction often leads to delays, miscommunication, and extra costs - sometimes adding up to $47,000 in unexpected expenses. On the other hand, integrated construction eliminates warranty gaps by offering single-point accountability. This means one team handles everything, ensuring clear communication and seamless warranty management.

Comprehensive warranty coverage goes beyond just repairs - it also protects your rental income. For example, if a major issue forces tenant relocation or delays in leasing, a 4-unit property could lose $8,800 per month in revenue. A strong warranty can help prevent these disruptions, keeping your returns intact.

Detailed documentation and daily updates are another key benefit. With clear records of what was built and when, disputes over whether an issue is due to construction defects or regular wear and tear are avoided, making warranty claims much smoother.

For owners of multi-unit properties, the risks are higher than with single-family homes. A structural problem in one unit can affect the entire building, and issues with the building envelope can spread across multiple units. With the right warranty in place - backed by an integrated construction approach - these challenges become manageable service calls, protecting both your investment and your peace of mind.

FAQs

How can I make sure my builder offers a reliable new home warranty in Nova Scotia?

To ensure your builder offers a dependable new home warranty in Nova Scotia, check if they’re registered with the Atlantic Home Warranty Program (AHWP). This program is a well-recognized benchmark for warranty protection in the region. Be sure the warranty specifics are clearly outlined in your purchase agreement, and don’t hesitate to ask your builder or sales representative to walk you through the coverage details.

A good warranty should cover structural defects, issues with workmanship, and problems with material quality. Having this kind of protection not only secures your investment but also provides reassurance during the construction phase and long after you’ve moved in.

How can I tell the difference between normal wear and tear and issues covered by a new home warranty?

Understanding what counts as normal wear and tear versus warranty-covered issues starts with checking the details of your warranty. In Nova Scotia, most new home warranties cover workmanship and materials for the first year, while major structural defects are generally covered for up to 10 years.

Normal wear and tear includes the minor signs of ageing that naturally happen over time - think small scuffs on the floor or paint that fades with exposure to sunlight. In contrast, warranty-covered issues involve defects or failures in construction or materials that go beyond everyday use. If you're uncertain about whether something is covered, take a closer look at your warranty documents or contact your builder for clarification.

How does an integrated design-build approach improve warranty coverage for multi-unit property owners?

An integrated design-build approach makes warranty coverage much simpler by offering single-source accountability. Instead of juggling multiple contracts and contractors, one team handles both the design and construction. This eliminates a lot of the back-and-forth, cutting down on delays, miscommunication, or disputes when warranty claims arise.

For property owners, this means faster solutions to problems like structural defects or workmanship issues. It’s a straightforward way to safeguard your investment and ensures there’s a clear, dependable process in place to address warranty concerns.