CMHC MLI Select for Investors: How 95% Financing Changes the Math on Building Rental Housing

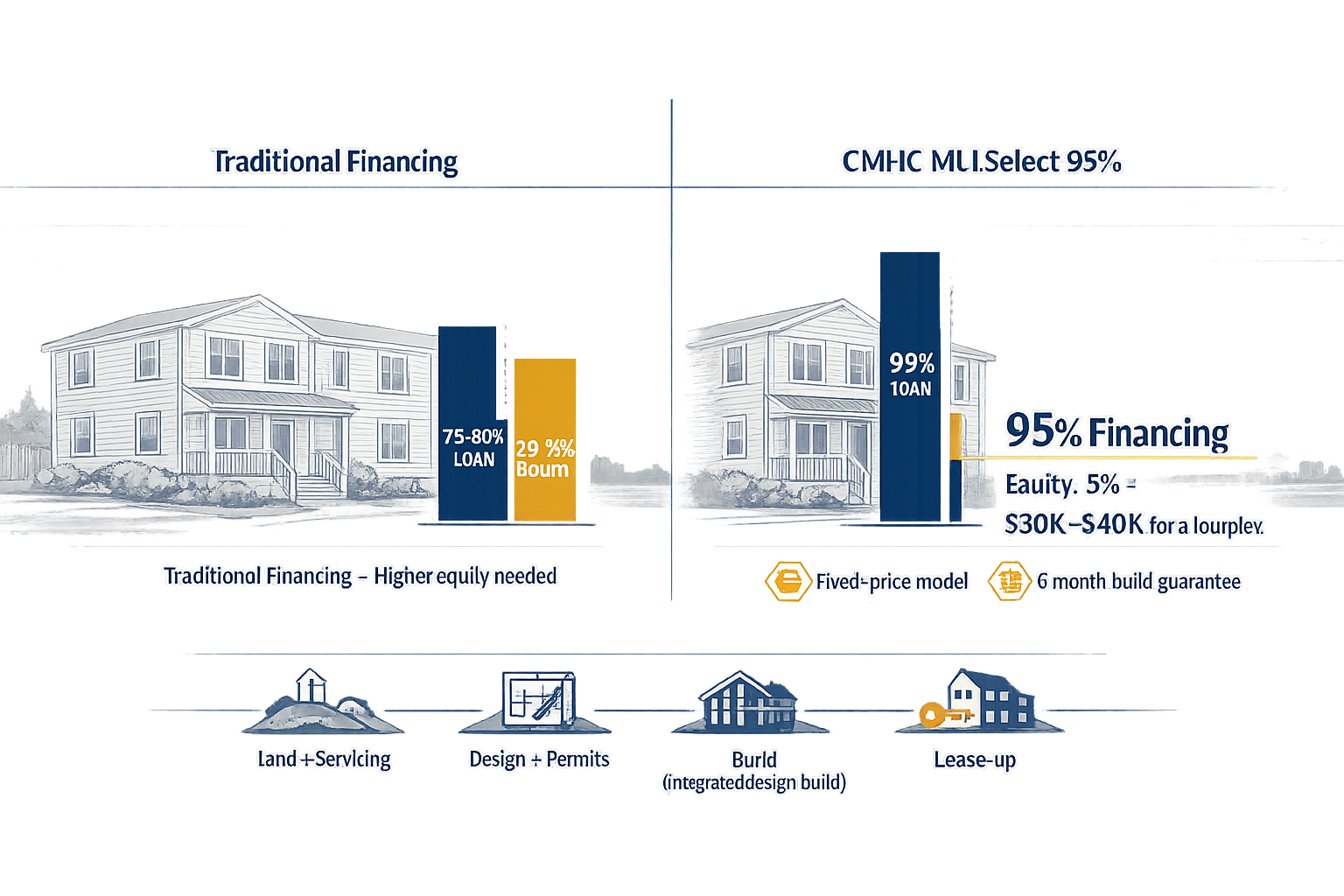

Building rental housing in Halifax and across Nova Scotia is expensive - costs for a fourplex range from $160,000 to $175,000 per unit. Traditionally, you'd need $128,000 to $175,000 upfront for a 20–25% down payment. With CMHC’s MLI Select program, that drops to just 5%, or $30,000 to $40,000. For property owners, this low equity requirement changes everything. Add in the option for 50-year amortization, and monthly payments shrink by about 12%. This article breaks down how MLI Select works, who qualifies, and how these terms can make projects financially feasible in Nova Scotia.

The REAL key to CMHC MLI Select - construction financing

sbb-itb-16b8a48

What CMHC MLI Select Is and How 95% Financing Works

CMHC MLI Select vs Conventional Financing Comparison for Nova Scotia Rental Projects

CMHC MLI Select is a mortgage loan insurance program designed for multi-unit rental projects that meet specific goals in affordability, energy efficiency, and accessibility [3][4]. It operates on a points-based system - projects earn points in these categories, and their total score determines the level of financing flexibility available [3].

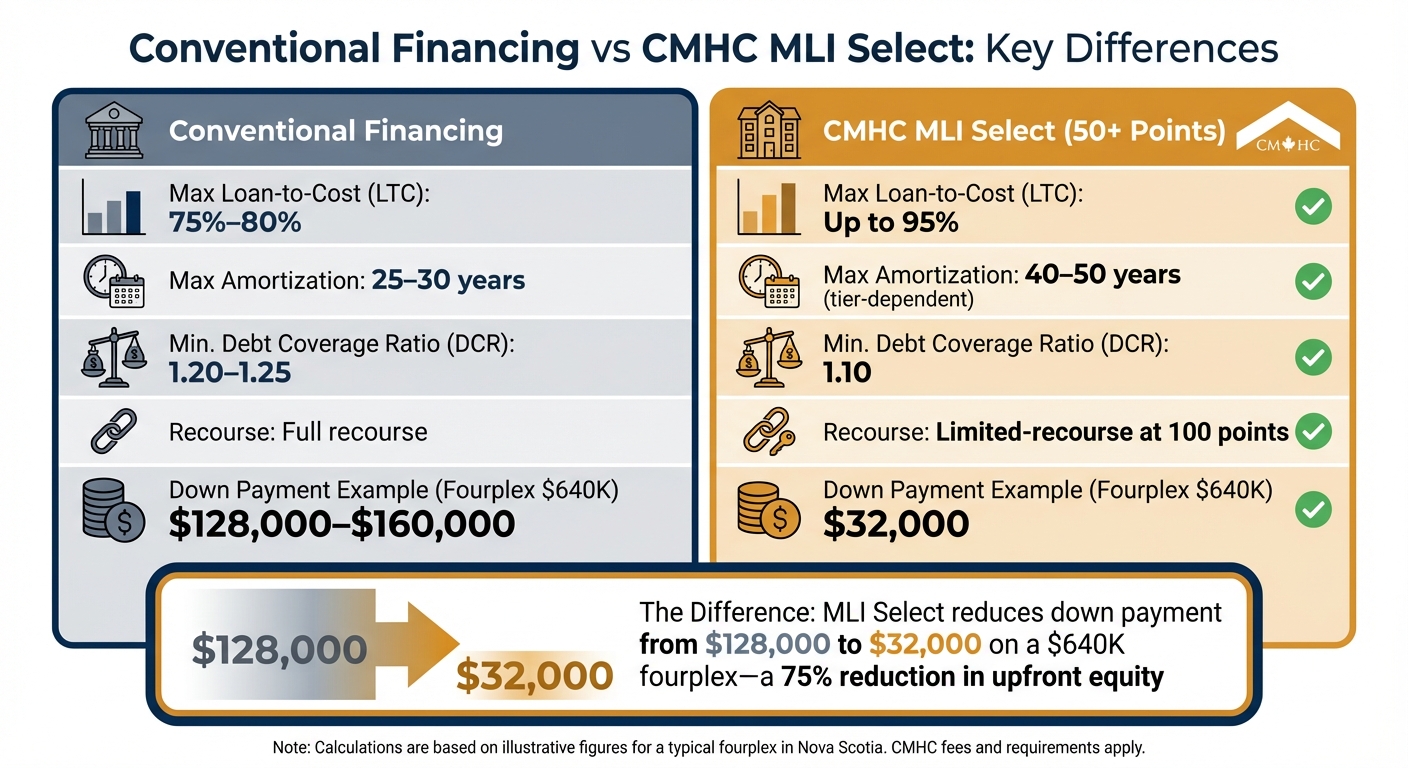

The standout feature of this program is the 95% Loan-to-Cost (LTC) ratio for new construction. If a project scores at least 50 points, the owner only needs to provide 5% equity. To put this into perspective, using Helio's $160,000-per-unit model for a fourplex (total cost: $640,000), the down payment drops from $128,000 (with a standard 80% LTC) to just $32,000.

MLI Select also offers longer amortization periods, ranging from 40 to 50 years depending on the points achieved, compared to the usual 25–30 years [3]. This extended timeline reduces monthly debt payments, improving cash flow. Additionally, the program allows for a lower minimum Debt Coverage Ratio (DCR) of 1.10, versus the 1.20–1.25 typically required by conventional lenders [3][4]. A lower DCR makes it easier for properties to qualify for maximum loan amounts, as they don't need as much surplus income.

| Feature | Conventional Financing | CMHC MLI Select (50+ Points) |

|---|---|---|

| Max Loan-to-Cost (LTC) | 75%–80% | Up to 95% |

| Max Amortization | 25–30 years | 40–50 years (tier-dependent) |

| Min. Debt Coverage Ratio (DCR) | 1.20–1.25 | 1.10 |

| Recourse | Full recourse | Limited-recourse at 100 points |

What this means for property owners: MLI Select reshapes the financial landscape for building rental housing. Dropping the equity requirement from 20–25% to just 5% means that a fourplex could be built with only $30,000–$40,000 down instead of $128,000–$160,000. When combined with longer amortization periods that reduce monthly payments, the program makes previously unworkable projects financially feasible. This is especially relevant in Nova Scotia, where the need for rental housing is growing. Up next, we’ll explore the criteria that projects need to meet to qualify for this type of financing in Nova Scotia.

Who Qualifies for MLI Select Financing in Nova Scotia

MLI Select financing is specifically designed for projects that meet certain criteria set by CMHC. Both the property and the borrower must satisfy these conditions to qualify for the 95% loan-to-cost structure.

Property requirements: Your project must include at least 5 units to be eligible (retirement homes require a minimum of 50 units or beds) [1][3]. Qualifying property types include standard rental buildings, SROs, supportive housing, and retirement homes, whether new or existing [3]. Student housing can also qualify, but only under the energy efficiency and accessibility categories - these projects cannot earn affordability points [1][3]. For mixed-use buildings, non-residential space cannot exceed 30% of either the gross floor area or the total lending value [1][3].

Borrower qualifications: Borrowers need to show at least 5 years of experience managing multi-unit properties or hire a professional property manager [1]. Additionally, CMHC requires borrowers to have a net worth equal to at least 25% of the loan amount, with a minimum threshold of $100,000. For example, a sixplex project costing $960,000 would require a net worth of at least $240,000 [1]. All projects must also adhere to the Prohibition on the Purchase of Residential Property by Non-Canadians Act [3].

These criteria provide property owners with access to substantial financing benefits, such as lower equity requirements. The 5-unit minimum means fourplexes won't qualify, but sixplexes, eightplexes, and larger buildings meet the standard. The experience requirement can easily be addressed by hiring a professional property manager, which often leads to better cash flow and higher tenant retention. While the net worth requirement may seem steep, it's attainable for many property owners who already have equity in other real estate or investments.

Next, we’ll break down how the points system influences access to 95% financing and longer amortization periods.

How the MLI Select Points System Works

The MLI Select program uses a scoring system based on three categories: Affordability, Energy Efficiency, and Accessibility. You can focus on one category or mix and match across all three. According to CMHC, "the more committed you are to social and environmental outcomes, the better the incentives" [3]. Scoring 50, 70, or 100+ points unlocks increasingly attractive financing terms, such as loan-to-cost ratios up to 95%, amortizations up to 50 years, and lower premiums [1][3]. Here's how each category contributes to your score:

For Affordability, you earn points by offering units at lower rents. Allocating 10% of units at or below 30% of the median renter income for 10 years earns 50 points. Increasing that to 15% earns 70 points, and 25% earns 100 points [3]. Committing to affordability for 20 years or more adds an automatic 30-point bonus to your score [1][3].

For Energy Efficiency, points are awarded based on how much better your project performs compared to the 2020 National Energy Code for Buildings (NECB). Exceeding NECB by 25% earns 20 points, a 50% improvement gets you 35 points, and a 60% improvement earns 50 points [3]. Energy modelling must be handled by qualified professionals, such as P.Engs, Architects, CEMs, or CETs, using CMHC-approved software [1][3].

For Accessibility, projects must first meet baseline requirements: 100% of units must meet "visitable" standards under CSA B651:23, and all common areas must be barrier-free [3]. Once the baseline is met, allocating 15% of units as accessible earns 20 points, while achieving full universal design or RHFAC Gold certification earns 30 points [3]. Starting July 14, 2025, projects scoring 50+ points will receive a 10% premium discount, 70+ points qualify for a 20% discount, and 100 points will earn a 30% discount [2].

For property owners: A simple combination of allocating 10% of units for affordability (50 points) and committing to 20 years (30-point bonus) totals 80 points. That puts you in the 70-point tier, qualifying for 95% financing, a 45-year amortization, and a 20% premium discount.

How to Apply for MLI Select Construction Financing

To apply for MLI Select financing, you must work with a CMHC Approved Lender. These lenders are your gateway to navigating CMHC’s underwriting process. The application unfolds in five steps: pre-application planning, documentation preparation, lender submission, CMHC underwriting, and post-construction verification.

Pre-application planning is where you set your strategy and bring in the right experts. For energy efficiency points, you'll need a qualified energy modeler - someone like a Professional Engineer, Architect, CET, or Certified Energy Manager - who can run ASHRAE Standard 140 simulations. For accessibility points, consult an architect or an accessibility specialist to confirm your designs meet CSA B651:23 standards, including barrier-free common areas. Pin down your affordability unit mix early, as bedroom counts and target rents are locked in once CMHC issues its commitment. This stage is critical to achieving financing terms like 95% loan-to-cost and extended amortization, which can make your project financially viable.

Documentation preparation involves pulling together a detailed and complete file. This includes:

- A pro forma rent roll outlining your affordability levels

- Signed energy simulation reports with borrower attestations

- Summaries of accessibility features verified by a consultant

- Proof of at least five years of multi-unit management experience (or a contract with a qualified third-party manager)

- Evidence of net worth equal to at least 25% of the loan amount, with a minimum of $100,000

Submitting a well-organized package helps minimize back-and-forth during the review process.

Once your lender submits the application, CMHC underwriting begins. Be ready for potential clarification requests as CMHC reviews your file. Timelines depend on the lender’s workload and your project’s complexity, but concise submissions can speed up approvals. After construction wraps, you’ll enter post-construction verification. Within 60 days of the final loan advance, you must submit signed attestations confirming that energy efficiency and accessibility targets were met, an updated rent roll, and an annual certificate of compliance for affordability commitments.

What this means for property owners: Early planning and professional input are key to success. If you’re working with pre-qualified designs like Helio’s standard fourplex, sixplex, or eightplex models, much of the heavy lifting - like energy modelling and accessibility compliance - is already handled. This simplifies your documentation and shortens approval timelines. With a strong application, you can lock in financing terms that significantly improve your project’s cash flow. We’ll dive into the financial details in the next section.

How 95% Financing Changes the Numbers on a $160K/Unit Build

With 95% financing, the upfront equity required for a project drops dramatically, reshaping how feasible a build can be. For a $160,000 per unit project - where construction costs are $160,000 per unit and total project costs are about 25% higher after factoring in land and soft costs - the difference in down payment requirements can determine how many projects you can take on and the returns you’ll see on your investment. Let’s break this down with some examples.

75% LTV vs 95% LTV: Side-by-Side Comparison

Take a fourplex as an example. The construction cost is 4 × $160,000 = $640,000, but total project costs usually reach $800,000 once land and soft costs are added. With traditional financing at 75% loan-to-value (LTV), you’d need a 25% down payment - $200,000 in this case. In contrast, CMHC MLI Select financing at 95% LTV requires only 5% down, or $40,000. For a sixplex, where construction costs are $960,000 and total project costs hit $1,200,000, you’d need $300,000 down with 75% LTV, compared to just $60,000 with MLI Select.

Here’s what the loans look like:

- Fourplex: A 75% LTV loan would be $600,000, while a 95% LTV loan would be $760,000.

- Sixplex: A 75% LTV loan would be $900,000, compared to $1,140,000 at 95% LTV.

Even though you’re borrowing more with MLI Select, the extended amortization - up to 50 years compared to the typical 30 years - keeps monthly payments manageable. This helps maintain cash flow while you expand your portfolio.

Why this matters for property owners: Lower equity requirements mean you can build more projects at the same time, accelerating portfolio growth. It also boosts your returns on the money you’ve invested. Let’s dive into a detailed example with a fourplex.

Fourplex Example: Cash-on-Cash Return Calculation

Imagine a fourplex with a total project cost of $800,000 (construction costs of $640,000 plus land and soft costs). Using MLI Select at 95% LTV and a 50-year amortization, your down payment would be just 5%, or $40,000. With monthly rents of $1,800 per unit, gross rent totals $7,200. After 30% operating expenses ($25,920 annually), your net operating income (NOI) is $60,480.

The loan amount would be $760,000 at 5% interest over 50 years, resulting in a monthly debt service of about $3,450 ($41,400 annually). This leaves you with an annual cash flow of roughly $19,080. On your $40,000 investment, that’s a 47.7% cash-on-cash return in the first year. Compare this to conventional financing at 75% LTV, where you’d need a $200,000 down payment. With a $600,000 loan at 5% over 30 years, the return drops to about 10.9%. MLI Select delivers over four times the cash-on-cash return by reducing your equity requirement.

Sixplex Example: 10-Year ROI Projection

Now consider a sixplex with a total project cost of $1,200,000 (construction costs of $960,000 plus additional expenses). With MLI Select at 95% LTV, your down payment would be 5%, or $60,000. Each unit rents for $1,750 monthly, giving you $10,500 in total monthly rent ($126,000 annually). After 30% operating expenses ($37,800 annually), your NOI is $88,200.

The loan amount would be $1,140,000 at 5% interest over 50 years, with a monthly debt service of about $5,175 ($62,100 annually). This leaves you with a first-year cash flow of approximately $26,100. Over 10 years, assuming 3% annual rent growth and 2% annual property appreciation, the NOI could grow to $115,000, with annual cash flow reaching $52,900. When you add up around $390,000 in total cash flow, $85,000 in mortgage principal paydown, and $262,000 from property appreciation, your total return could hit $737,000 on a $60,000 investment. That’s a 1,228% total ROI over 10 years, or about 29% annually - numbers that are particularly relevant for Nova Scotia’s rental market.

"It allows investors to think long-term. You're not just building for today's market, you're financing in a way that protects future cash flow and creates sustainability in both your balance sheet and the community" [6].

Why this matters for property owners: MLI Select turns rental housing into a cash flow powerhouse. The combination of low equity requirements, long amortization periods, and stable debt service against rising rents creates returns that conventional financing can’t compete with.

Why Nova Scotia Works Well for MLI Select Projects

Nova Scotia stands out for MLI Select projects thanks to its favourable regulations, lower costs, and faster timelines, all of which align with CMHC's financing benefits.

For 2026, Nova Scotia allows affordable rent increases of 4.7%, linked to the Consumer Price Index. This is higher than Ontario's 2.9%, British Columbia's 3.0%, or Alberta's 1.3% [3]. This higher cap enables faster net operating income (NOI) growth while staying within affordability guidelines.

On the construction side, costs in Nova Scotia average $160,000 per unit, with total development expenses hovering around $175,000 per unit [5]. Paired with MLI Select's 95% loan-to-value financing, these lower costs mean developers need less upfront equity compared to pricier markets.

Another major advantage is speed. Projects in Nova Scotia can be completed in as little as 6 months, compared to the typical 18 months elsewhere [5]. This faster timeline significantly reduces potential rental income losses. For example, cutting the build time from 18 to 6 months on a sixplex can save roughly $144,000 in lost rent [5].

These regional factors amplify the financial benefits of MLI Select. Higher rent increase caps drive stronger NOI growth, while competitive construction costs and shorter timelines let investors start earning sooner. Over time, these advantages can add up, making Nova Scotia a compelling choice compared to regions with stricter rent controls and longer project timelines.

How to Use MLI Select in Your Investment Plan

Start by aiming for the 100-point tier right from the beginning. For a sixplex valued at $960,000, moving from 75% conventional financing to 95% MLI Select reduces the upfront equity requirement by around $192,000. That’s capital you can redirect to another project or use to minimize reliance on external partners. To hit the 100-point target, combine a 20-year affordability commitment (adding 30 points) with energy efficiency upgrades (20–40% above the 2020 national energy code) and ensure all units meet baseline accessibility standards like 100% visitability under CSA B651:23 [1][3].

Involve specialists early in the process. Bringing in energy modellers and accessibility consultants during the design phase helps you avoid retrofit costs, which can run 20–30% higher than designing for compliance from the start [1].

"Pick a realistic target tier with your design and ops team, then reverse-engineer the building and the budget to hit it" [1].

This approach also lays the groundwork for refining your unit mix.

Fine-tune your unit mix. Smaller units like studios and one-bedrooms are key to meeting affordability thresholds tied to median renter income while keeping construction efficient. If you're building in Nova Scotia, check your municipality’s CMHC data on median renter income before locking in your bedroom counts. This ensures your "affordable" rents cover operating costs and maintain at least a 1.10 Debt Service Coverage Ratio. Aligning unit mix with affordability requirements strengthens the financial advantages of the program.

Finally, the 50-year amortization available at the 100-point level reduces monthly debt service and allows for larger loan amounts based on the same NOI [3]. Coupled with Nova Scotia's 4.7% rent increase cap for 2026, this extended amortization supports NOI growth while keeping payments manageable [3].

FAQs

Does MLI Select cover land and soft costs, or just construction?

MLI Select focuses on financing construction costs, along with soft costs and land acquisition expenses. While it doesn't break out land and soft costs as separate categories, these are generally included within the total project budget. Typically, soft costs account for 20% to 30% of the overall project cost, and land expenses are usually incorporated into the financing structure.

How can I estimate if my project will achieve 50, 70, or 100+ points?

To gauge how your project measures up under the CMHC MLI Select program, start by examining the points-based criteria tied to outcomes such as affordability, energy efficiency, and accessibility. Decide which outcomes you aim to prioritize and ensure you document your commitments in detail. Tools like score calculators can be helpful for modelling your potential score, factoring in specifics like the loan size and the outcomes you’re targeting. Ultimately, your final score will hinge on how closely your project aligns with the program’s criteria and the quality of the supporting documentation you provide.

What are the main risks of using 95% financing with a 50-year amortization?

Higher interest rates, a drop in property values leading to negative equity, and potentially higher lending fees are the main risks to consider. Each of these can cut into your profitability. It's crucial to evaluate these factors thoroughly before moving forward.