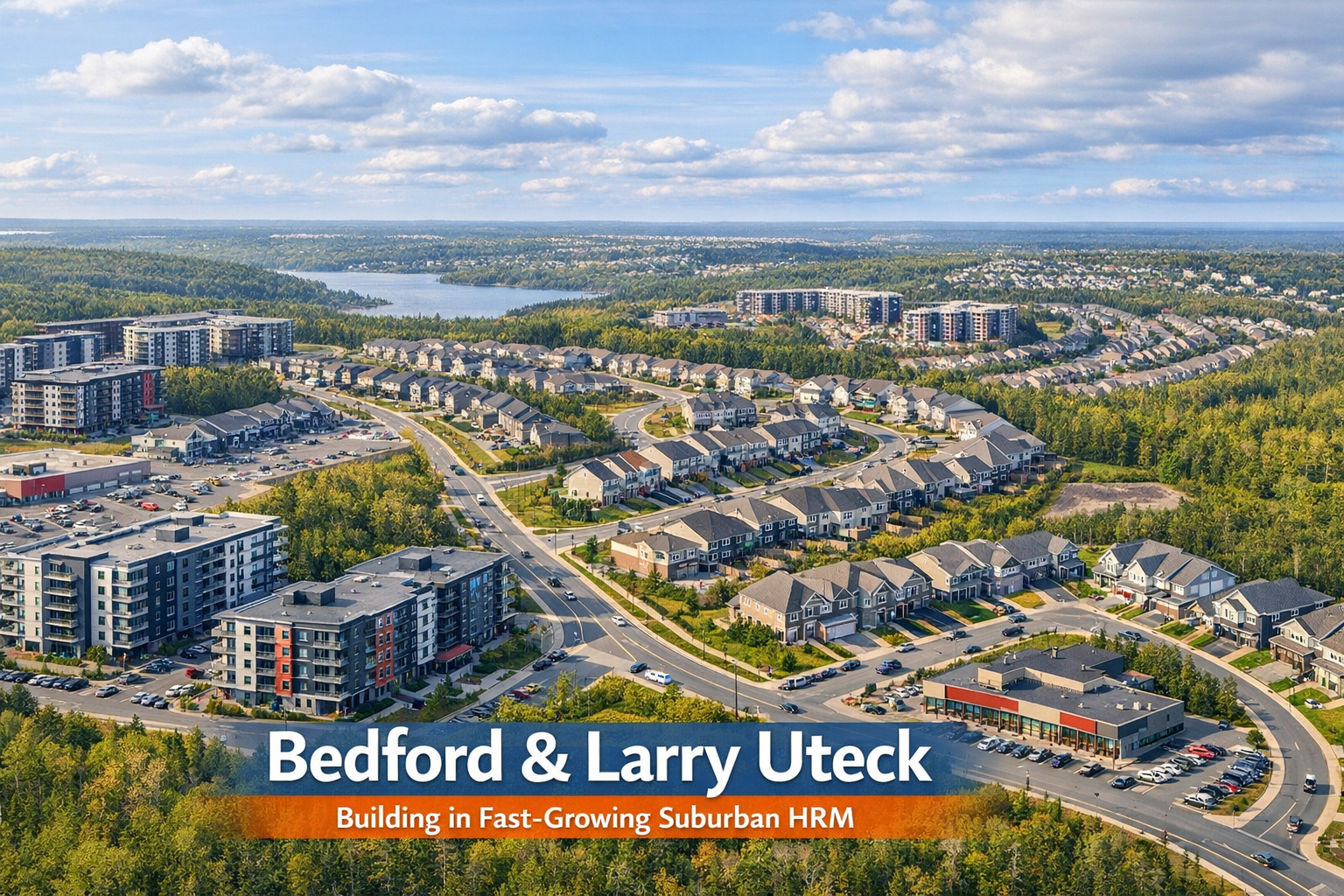

Bedford & Larry Uteck: Building in Fast‑Growing Suburban HRM

Bedford and Larry Uteck in Halifax are booming suburban areas with high housing demand and low rental vacancy rates (0.5% as of late 2024). These neighbourhoods attract young families and professionals due to their proximity to key employment hubs, family-friendly amenities, and easy access to Halifax’s core areas.

Key points:

- Population Growth: Halifax's population hit 500,000 in 2024, with Bedford South expected to surpass 17,000 residents soon.

- Rental Market: Bedford’s average rent is $1,922/month - among the highest in the region.

- Development Surge: Over 13,000 housing units are under construction in Halifax, 81% of which focus on rentals. Bedford Commons alone plans to add 6,216 units.

- Zoning Updates: New rules allow up to four units on most residential lots, streamlining smaller developments.

- Challenges: Sewer capacity, rising construction costs (up 8.3% in 2023), and limited transit options require careful planning.

For investors, integrated design-build methods offer cost control, fixed timelines, and simplified project management, ensuring faster completion and better returns. Combining energy-efficient designs with CMHC MLI Select financing can lower upfront costs while maximizing rental income.

Population Growth and Rental Demand

Population and Household Data

Halifax reached a population milestone of 500,000 in 2024, following a significant 19,000-person increase (about 4%) in 2023. Much of this growth has centred around Bedford and Larry Uteck, thanks to their close proximity to key employment hubs like Burnside Industrial Park and the Bedford Common commercial area [1][2].

The 15–34-year-old age group continues to play a major role in driving rental household formation across Nova Scotia. However, growth in this demographic slowed to 0.7% in 2025, a noticeable drop from 5.7% in 2024 [4]. Despite this deceleration, the Bedford South area is expected to surpass 17,000 residents as high-density suburban developments expand [5]. Core tenants in the region include young families, military personnel, and professionals aged 28–45, who prefer rental units that combine the comfort of single-family homes with the practicality of multi-unit living [1].

Rental Market Conditions

Bedford's rental market reflects extremely tight conditions, with vacancy rates as low as 0.5%, well below Halifax's average of 2.1% and the national average of 3.1% for major urban centres [1][4]. This low vacancy rate highlights strong demand and high absorption in the area. These trends point to broader challenges in zoning, planning, and infrastructure within the Halifax Regional Municipality (HRM).

Zoning, Planning, and Infrastructure

Zoning Rules for Multi-Unit Buildings

Bedford West Sub-Areas 1 and 12 operate under a Special Planning Area (SPA) designation, which alters the usual approval process. Instead of the traditional route involving public hearings and council decisions, applications are reviewed by the Executive Panel on Housing and finalized by the Minister of Municipal Affairs and Housing. This streamlined process comes with its own set of rules and adjustments.

For single-lot properties along Larry Uteck Boulevard and Hammonds Plains Road that don't require new infrastructure, the municipality has introduced new zones and built-form regulations to allow "as-of-right" development. This means property owners can proceed without needing a Development Agreement. However, for larger, master-planned developments, Development Agreements are still required to manage infrastructure elements like streets, sidewalks, and nature corridors.

The Bedford West Secondary Plan plays a critical role in guiding development in the area. One key requirement is a master stormwater plan, which can significantly impact site preparation costs and timelines. Sewer capacity is another major consideration, as it is tightly regulated by population caps set under the Regional Subdivision By-law. Recent proposals advocating for higher-density developments could further complicate these calculations. These zoning regulations directly influence project costs, timelines, and potential returns, setting the stage for the challenges and strategies explored below.

Infrastructure Capacity and Access

Infrastructure plays a pivotal role in development, often presenting significant challenges. Sewer capacity, for instance, is calculated based on the projected population outlined in the Bedford West Secondary Plan. As Duncan Williams, President of the Construction Association of Nova Scotia, pointed out:

"Since 2020, the cost of materials and building in general … has doubled" [3].

This makes early planning essential to account for sewer capacity and related infrastructure costs.

Access to roads is another critical factor. For example, the Bedford Commons development hinges on the extension of Damascus Road to Rocky Lake Drive, which will serve as the main access point for this new high-density area [2]. Similarly, modern developments like Brookline Park have adopted underground services to meet "X-Urban" standards, which adds to upfront expenses [6]. Transit infrastructure remains limited, with the Bedford Commons area currently served by just one Halifax Transit route along Damascus Road [2].

Environmental considerations also play a role. Proximity to the Sackville floodplain necessitates specific runoff control measures [2], while the disposal of pyritic slate - a common issue in Halifax Regional Municipality (HRM) construction - can further increase site preparation costs and timelines. These factors, combined with rising costs and limited transit options, heavily influence construction methods and project planning. With around 81% of new housing starts in Halifax aimed at the rental market [3], understanding these variables early on is crucial to ensure project viability.

Halifax Announces Special Planning Areas for New Housing Developments

sbb-itb-16b8a48

Integrated Design‑Build vs. Traditional Construction

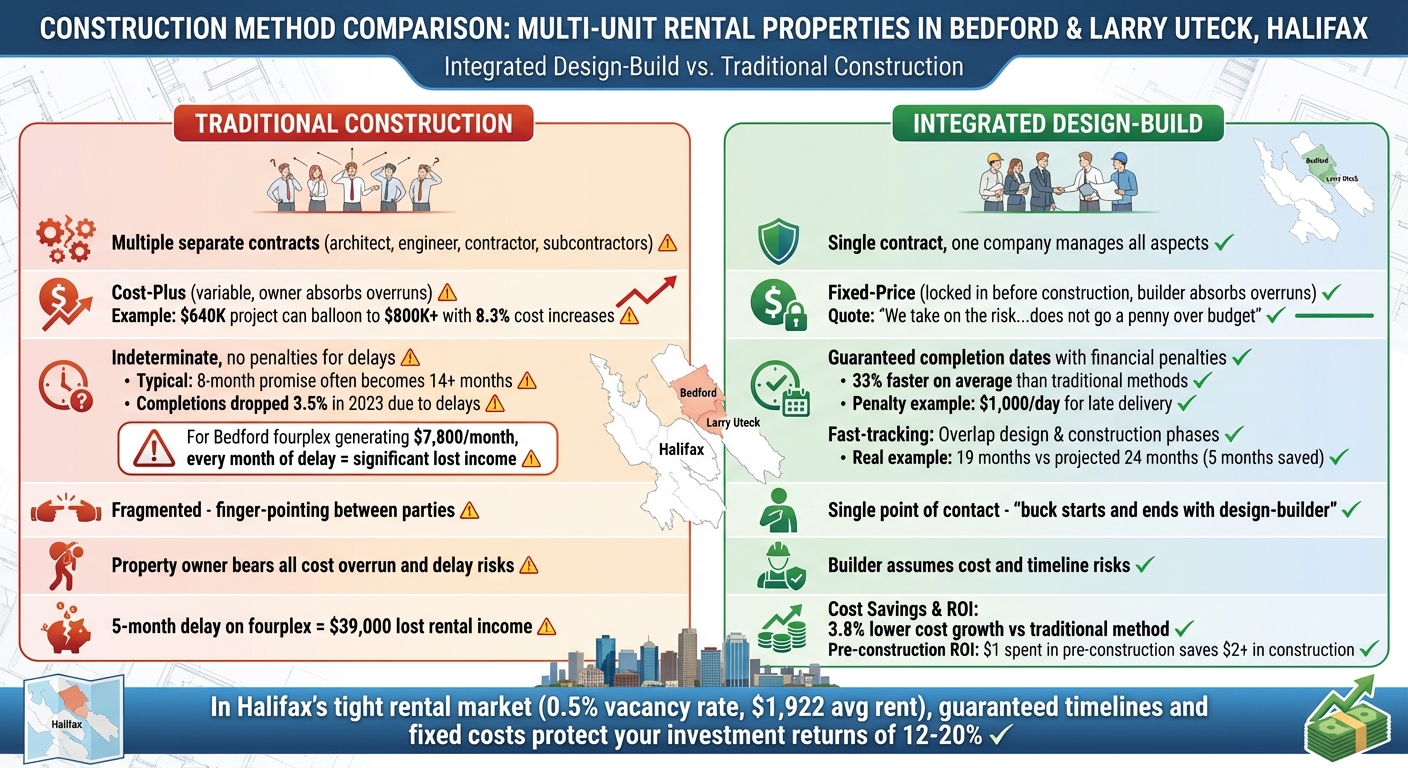

Integrated Design-Build vs Traditional Construction: Cost, Timeline & Risk Comparison

Building a 4–24 unit rental property in areas like Bedford or Larry Uteck often means juggling architects, engineers, contractors, and a host of subcontractors - each with its own contract. This fragmented setup frequently leads to inefficiencies, stretching what should be an 8‑month project far beyond its timeline. In fact, despite new housing starts in Halifax, actual completions dropped by 3.5% in 2023, as builders struggled to finish projects due to labour shortages and capacity issues [1]. Let's dive into how an integrated design‑build approach can address these challenges.

Integrated design‑build takes a different route. Instead of separate contracts, one company oversees planning, architecture, engineering, and construction under a single agreement. This eliminates the blame game between designers and contractors that often slows traditional projects. As Jordan Sinz, Former District Administrator at Wisconsin Heights School District, put it when discussing their choice of design‑build for a campus renovation:

"The board and I did not want any buck‑passing or finger‑pointing. With design‑build, the buck started and ended with the design‑builder" [9].

The numbers back this up. On average, design‑build projects are completed 33% faster than traditional methods [8], with cost growth 3.8% lower than the typical design‑bid‑build approach [9]. For property owners in Bedford and Larry Uteck - where average rents hover around $1,922 per month - every month of delay could mean thousands of dollars in lost income. Bob Deeks, President of RDC Fine Homes, sums it up well:

"For every dollar that you spend in pre‑construction, I guarantee you, you will save at least $2 in construction" [14].

Next, we'll explore how contract types, timelines, and accountability differ between these approaches, showing why integrated design‑build is a smart choice.

Fixed‑Price vs. Cost‑Plus Construction

Cost‑plus contracts can leave property owners vulnerable to budget overruns. With Halifax's residential construction cost index climbing 8.3% in 2023, a project initially estimated at $640,000 can easily balloon to $800,000 or more due to material price hikes or design errors requiring costly mid-construction fixes. In these cases, the property owner absorbs every unexpected expense.

Fixed‑price contracts remove this uncertainty. The total cost is locked in before construction begins, transferring the risk of cost overruns to the builder. As one integrated firm explains:

"As an integrated firm we have the ability to guarantee a maximum price on a project... we take on the risk of the guaranteed price so we fight to ensure that the client's project does not go a penny over budget" [12].

This approach is especially valuable in Bedford and Larry Uteck, where infrastructure considerations - like stormwater management and sewer capacity - can significantly affect site preparation costs. Knowing your exact costs upfront allows for precise financial planning, protecting your return on investment from unexpected market shifts.

Guaranteed Timelines vs. Indeterminate Timelines

Integrated design‑build also shines when it comes to timelines. Traditional construction often operates on loose schedules, with no penalties for delays. A contractor might promise an 8‑month timeline but take 14 months to deliver, leaving you without rental income in the meantime. In Halifax, where skilled trades shortages are a persistent issue, delays have become all too common.

With design‑build, firms can guarantee completion dates because they manage every aspect of the project. By overlapping design and construction phases - known as "fast‑tracking" - they can start site work while finalizing interior plans. For instance, a public administrative office building shaved five months off its timeline by pouring the concrete pad while waiting for final design permits, completing the project in 19 months instead of the projected 24 [10].

For a fourplex in Bedford generating $7,800 monthly in rental income, a five‑month delay could mean a $39,000 loss. Guaranteed timelines, often backed by financial penalties for late delivery (e.g., $1,000 per day), ensure builders stay on track and property owners can confidently plan their cash flow.

Single Accountability vs. Multiple Contracts

Traditional construction requires property owners to manage separate contracts for architects, engineers, and contractors. This fragmented setup often leads to disputes and costly change orders.

Integrated design‑build simplifies this process by consolidating all responsibilities under one company. From the concept phase onward, builders and engineers collaborate to identify potential structural or mechanical issues, reducing the likelihood of expensive mid-construction changes [11][13]. Bryan Knupp, Senior Vice President at Edifice, explains:

"The documents are more complete, which ultimately means fewer field delays due to changes and fewer change orders. Our goal is zero changes, and this is one of the best methods to obtain this goal" [10].

This streamlined approach is particularly important in Bedford and Larry Uteck, where development agreements and municipal infrastructure requirements demand precise technical documentation. A single point of accountability ensures seamless communication with planners and helps your project meet all regulations without the headaches of coordinating multiple contracts.

For property owners in Halifax's competitive rental market, these integrated methods are key to completing projects efficiently and protecting returns on investment.

How to Maximize Returns in Bedford and Larry Uteck

Property owners in Bedford and Larry Uteck can achieve annual returns of 12–20% by focusing on three essential areas: incorporating sought-after design features to command higher rents, leveraging strategic financing options like CMHC programs, and tightly managing construction costs. These strategies work together to boost profitability by minimizing delays and avoiding unnecessary expenses. Let’s dive into the details with real numbers to back it up.

Design Features That Boost Rental Income

In Larry Uteck, modern finishes and in-suite amenities are key to charging premium rents. For instance, 93% of renters consider air conditioning and in-suite laundry essential [15]. Properties featuring granite or quartz countertops, stainless steel appliances, and high-quality flooring can command rents for one-bedroom units ranging from C$2,150 to C$3,022 [16].

Tech amenities also play a significant role in increasing rental value. Data shows that 57% of tenants are open to rent hikes for smart home features, 90% demand reliable high-speed internet, and 86% of millennials are willing to pay more for advanced tech offerings [15]. Adding smart building access, mobile platforms for rent and maintenance, and EV charging stations can attract these tech-savvy renters.

The neighbourhood itself adds to the appeal. Properties with Bedford Basin views or proximity to convenient shopping hubs - like Sobeys, Goodlife Fitness, and local cafés - can justify higher rents. As Charles, a local developer, explains:

"The Larry Uteck neighbourhood provides easy access to downtown connector routes and convenient proximity to Bedford's fastest growing selection of markets, dining, recreation and wellness amenities" [16].

Luxury three-bedroom suites in the area, averaging 1,570 sq ft, typically rent for C$3,568 to C$3,659 [16]. While these design elements enhance rental income, pairing them with smarter financing can take returns even further.

Smarter Financing With CMHC MLI Select

Beyond design upgrades, financing strategies can significantly improve cash flow and project feasibility. The CMHC MLI Select program is a game-changer, offering up to 95% financing with a 50-year amortization period. This dramatically lowers monthly debt payments compared to traditional mortgages [1]. For example, a fourplex costing C$800,000 to build requires just a 5% down payment (C$40,000) under this program, compared to a 20% down payment (C$160,000) with standard financing.

The extended amortization period keeps monthly payments manageable. Eligibility is based on a points system that considers affordability, energy efficiency, and accessibility. To qualify, buildings must be at least 40% more energy efficient than the minimum building code, which increases construction costs to roughly C$200,000 per unit from the standard C$160,000. However, the program’s financing leverage - 20:1 compared to the typical 5:1 - offsets these costs, allowing property owners to scale their portfolios faster while maintaining strong cash flow.

Bedford Fourplex: Numbers That Work

Let’s break down the numbers for a fourplex. A project built at C$160,000 per unit (totalling C$640,000) generates monthly rents of C$7,800 to C$8,400, with each two-bedroom unit renting for C$1,950 to C$2,100. After covering expenses, property owners can expect an annual ROI of 12–20%.

If you opt for CMHC MLI Select financing, unit costs rise to C$200,000 (totalling C$800,000). However, with 95% financing and a 50-year amortization, you only need a down payment of C$40,000. This setup allows you to control a property generating between C$93,600 and C$100,800 in annual gross rents. The extended amortization keeps payments low, while energy-efficient features attract tenants willing to pay premium rents and reduce operating costs.

Timely construction is critical to maximizing returns. Every month of delay can cost you C$7,800 to C$8,400 in lost rental income. Partnering with integrated design-build firms that guarantee completion within six months - and impose penalties of up to C$1,000 per day for delays - ensures you start collecting rent on time. By focusing on smart design, strategic financing, and efficient construction, property owners in Bedford and Larry Uteck can achieve impressive returns on their investments.

Conclusion

Bedford and Larry Uteck stand out as prime areas for multi-unit rental investments in suburban HRM. With 6,216 new units proposed at Bedford Commons, a 32% rise in housing starts, and a 13.1% population growth on the Halifax Mainland, rental returns ranging from 12% to 20% are well within reach[2][3][7]. The demand for rentals is strong, with 81% of all new housing starts focused on the rental market[3].

Given these market dynamics, selecting the right construction method becomes crucial. Traditional construction methods, with their reliance on multiple contracts, cost-plus pricing, and unpredictable timelines, often leave property owners exposed to delays and lost rental income. In contrast, the integrated design-build approach offers a streamlined solution. By bringing planners, architects, engineers, and construction teams together under one roof, this method ensures fixed pricing and guaranteed timelines, significantly reducing risks.

With favourable market conditions, steady rental demand, and accessible CMHC MLI Select financing, property owners have a unique opportunity to maximize returns. By opting for the integrated design-build method, they can ensure efficient project delivery, avoid budget overruns, and meet timelines with confidence. This approach provides a clear path to capitalizing on the strong rental market in Bedford and Larry Uteck.

FAQs

What challenges do property owners face when building in Bedford and Larry Uteck?

Property owners in Bedford and Larry Uteck are grappling with the challenges brought on by rapid growth and shifting infrastructure needs. In Bedford, large-scale housing developments like Bedford Commons demand substantial municipal planning adjustments. These include revisions to zoning, land-use bylaws, and the Regional Municipal Planning Strategy. Such changes must go hand in hand with major infrastructure upgrades - think new water and sewer systems, expanded road networks, and improved transit services - all necessary to keep up with the area's fast-paced expansion.

Meanwhile, Larry Uteck faces its own set of hurdles. The demand for mixed-use housing is soaring, but the area still lacks a fully developed network of essential services, such as parking, utilities, and reliable transit connections. Adding to the complexity, vacancy rates in the Halifax Regional Municipality (HRM) are strikingly low - sometimes dipping to just 0.5%. While building permits are being issued at a rapid pace, this raises concerns about whether the market can absorb such growth without risking overbuilding.

On top of that, property owners must navigate a maze of regulations, including strict height and density limits, reduced parking requirements, and affordable housing mandates - all while dealing with rising construction costs and labour shortages. Together, these factors create a challenging landscape for anyone involved in multi-unit residential construction in these suburban neighbourhoods.

What are the advantages of using an integrated design-build approach for property owners?

An integrated design-build approach streamlines the entire construction process by combining design and construction into a single contract. This eliminates the usual disconnect between designers and builders, cutting down on delays, unexpected costs, and miscommunication. With one team handling everything, property owners enjoy clear pricing and can plan their budgets with confidence, thanks to fixed-price or design-to-budget quotes provided upfront.

This method also simplifies communication. Instead of juggling multiple vendors, property owners have a single point of contact throughout the project. Decisions on design, permits, and materials become more efficient, often speeding up project timelines by 10–20%. In Halifax’s booming rental market, this time-saving approach helps owners meet growing demand faster.

By merging design and construction, property owners also benefit from improved quality control and fewer disputes. Collaborative planning leads to tenant-friendly layouts that can boost rental income and ROI. With one team accountable for the entire project, any issues are resolved quickly, ensuring a smoother process and a better final result.

What are the financing options for building small multi-unit rentals in Halifax?

Financing small multi-unit rental properties in Halifax depends on the scope of your project and your financial objectives. While exact options can vary, here are a few common pathways to consider:

- Local financial institutions: Halifax-based banks and credit unions often provide specialized mortgage products tailored for small rental developments. These can be a good starting point for securing funding.

- CMHC programs: The Canada Mortgage and Housing Corporation offers loans and incentives aimed at multi-unit residential projects, especially those designed to improve housing affordability.

- Municipal initiatives: Halifax may offer local housing grants or programs, particularly in high-demand areas like Bedford and Larry Uteck, to encourage rental property development.

To find the best financing solution for your project, it’s a good idea to speak directly with banks, CMHC representatives, or Halifax’s municipal housing offices for the latest information and guidance tailored to your needs.