Nova Scotia’s housing market is being reshaped by an influx of new residents. Here’s what’s happening:

- Migration Surge: People are moving to Nova Scotia from other provinces and internationally, drawn by lower living costs, remote work opportunities, and a better quality of life.

- Rental Market Pressure: Vacancy rates are at historic lows, rents are rising, and competition for housing is intense.

- Multi-Unit Housing Demand: Single-family homes aren’t enough to meet the demand. Multi-unit rentals are emerging as a practical solution, offering better land use and steady returns for property owners.

- Investment Opportunity: Multi-unit projects can generate 12–20% annual returns, with financing options and efficient construction methods making them attractive for investors.

The housing market’s challenges present a clear opportunity for property owners and developers to address rental shortages while achieving strong financial returns.

Migration Patterns and Housing Market Impact

Who's Moving to Nova Scotia and Why

Nova Scotia's rental market is buzzing, thanks to a mix of domestic movers, international arrivals, and young professionals. Many domestic migrants are drawn by the promise of affordable housing compared to larger cities, while international newcomers often start their journey in rental properties before considering homeownership. Younger renters, on the other hand, are gravitating toward modern, energy-efficient apartments that offer easy access to jobs and lifestyle perks.

These migration trends are creating noticeable population booms in specific regions.

Population Growth in Key Areas

The population surge in Nova Scotia is especially evident in areas within commuting distance of Halifax. The Halifax Regional Municipality remains a magnet for newcomers, but surrounding communities are also seeing steady growth. Downtown Halifax and nearby Dartmouth are hot spots, thanks to their proximity to universities, hospitals, and tech hubs, making them ideal for those seeking modern, multi-unit rentals. Suburban areas like Bedford and Sackville are appealing to families looking for suburban living without losing access to the city.

Beyond Halifax, smaller regions like the Annapolis Valley are becoming popular with remote workers drawn to the area's lifestyle benefits and manageable access to the city. South Shore towns like Lunenburg and Mahone Bay are seeing a shift from seasonal to year-round residents, further emphasizing the need for more rental options. Even rural areas within commuting range of Halifax, such as parts of the Eastern Shore and Musquodoboit Valley, are experiencing growth, although rental housing in these areas remains scarce.

This population concentration is putting increasing strain on the rental market.

Rental Market Pressure Points

With migration and population growth at full tilt, Nova Scotia's rental market is under serious pressure. Vacancy rates are at historic lows, rents are climbing, and competition among tenants is fiercer than ever.

Landlords are reporting a surge in applications for modern, well-situated units, reflecting a strong demand not just in Halifax but also in smaller markets. However, there's a clear gap in the availability of newer, energy-efficient rental properties. Much of the current rental stock consists of older buildings, leaving an opportunity for property developers to create thoughtfully designed, multi-unit housing that aligns with the needs of today's renters.

This growing demand highlights the need for creative solutions to meet the evolving expectations of tenants across the province.

Real Estate Investing in Nova Scotia | Rent Control, Market Growth & Nova Scotia Landlord Community

Multi-Unit Rental Property Opportunities

Nova Scotia's rental market presents a promising avenue for multi-unit construction. Projects ranging from 4 to 24 units are particularly well-suited to the region's housing needs and practical to build. By focusing on this range, property owners can address local demand while maximizing the potential of their land through multiple income streams.

Why Multi-Unit Rentals Make Sense

Multi-unit properties are an efficient way to meet housing demand and generate solid financial returns. Higher-density construction optimizes land use and aligns with municipal policies that prioritize projects like fourplexes or larger buildings over single-family homes. Plus, shared walls, centralized systems, and the ability to buy materials in bulk all contribute to lower construction costs and higher rental profits.

Financial Benefits of Multi-Unit Construction

The numbers speak for themselves. In key Nova Scotia markets, two-bedroom rental units typically fetch between $1,950 and $2,100 per month. This translates to annual returns of 12–20%. With construction costs averaging $160,000 per unit, a fourplex generating $7,800–$8,400 in monthly rent ensures steady cash flow and long-term value. Financing options through CMHC MLI Select make the deal even sweeter, offering up to 95% financing with a 50-year amortization period. This can provide leverage ratios as high as 20:1, far surpassing traditional financing. Additionally, an integrated design-build process guarantees fixed-price construction within six months, allowing owners to quickly transition to permanent financing. These financial advantages make multi-unit projects an attractive investment.

Appealing to a Wide Range of Tenants

Modern multi-unit rentals are designed to attract a diverse tenant base. Tenants are drawn to properties that emphasize quality construction, energy efficiency, and modern amenities. These features ensure that the homes meet current standards for comfort and reliability, making them highly appealing to renters looking for a dependable and enjoyable living experience.

sbb-itb-16b8a48

Construction Methods: Fragmented vs. Integrated Design-Build

In Nova Scotia, property owners face a critical decision when starting construction projects: choosing between a fragmented contractor approach or an integrated design-build team. This choice can significantly influence costs, timelines, and the stress involved in managing a complex build.

Challenges of Fragmented Construction

The traditional construction model relies on coordinating multiple independent professionals, such as architects, engineers, and contractors. Each operates separately, often with conflicting priorities, timelines, and communication styles.

Budget overruns are a frequent issue in fragmented projects. Without a single entity overseeing costs, expenses often spiral out of control. For instance, a fourplex initially estimated at $640,000 can easily inflate to $900,000 or more - an increase of 30–60%.

Delays are another common problem. Projects intended to take 8 months can stretch to 18 months, resulting in significant financial losses. For rental properties, this could mean losing up to $8,800 per month in potential income.

Accountability gaps add to the frustration. With responsibilities divided among multiple parties, disputes often arise, leaving property owners to mediate and resolve conflicts themselves.

Advantages of Integrated Design-Build

The integrated design-build approach eliminates many of these issues by bringing all professionals - planners, architects, engineers, and construction teams - under one roof. This unified structure fosters collaboration, shared accountability, and streamlined processes.

Fixed-price contracts are a cornerstone of this method. By identifying potential issues early in the planning phase, unexpected cost increases are avoided. Property owners gain clarity, knowing their exact financial commitment before construction begins.

Guaranteed timelines are another major benefit. With a single team managing the entire project, advanced scheduling systems ensure trades and deliveries are coordinated efficiently. Projects that might take 12–18 months under a fragmented model can often be completed in as little as 6 months.

Single-source accountability simplifies the process for property owners. Instead of juggling multiple points of contact, they work with one integrated team that handles all aspects of the project. This structure resolves disputes internally, sparing owners unnecessary stress.

Efficient communication is another key advantage. Rather than dealing with scattered emails and phone calls, property owners can rely on a centralized project portal for updates and coordination.

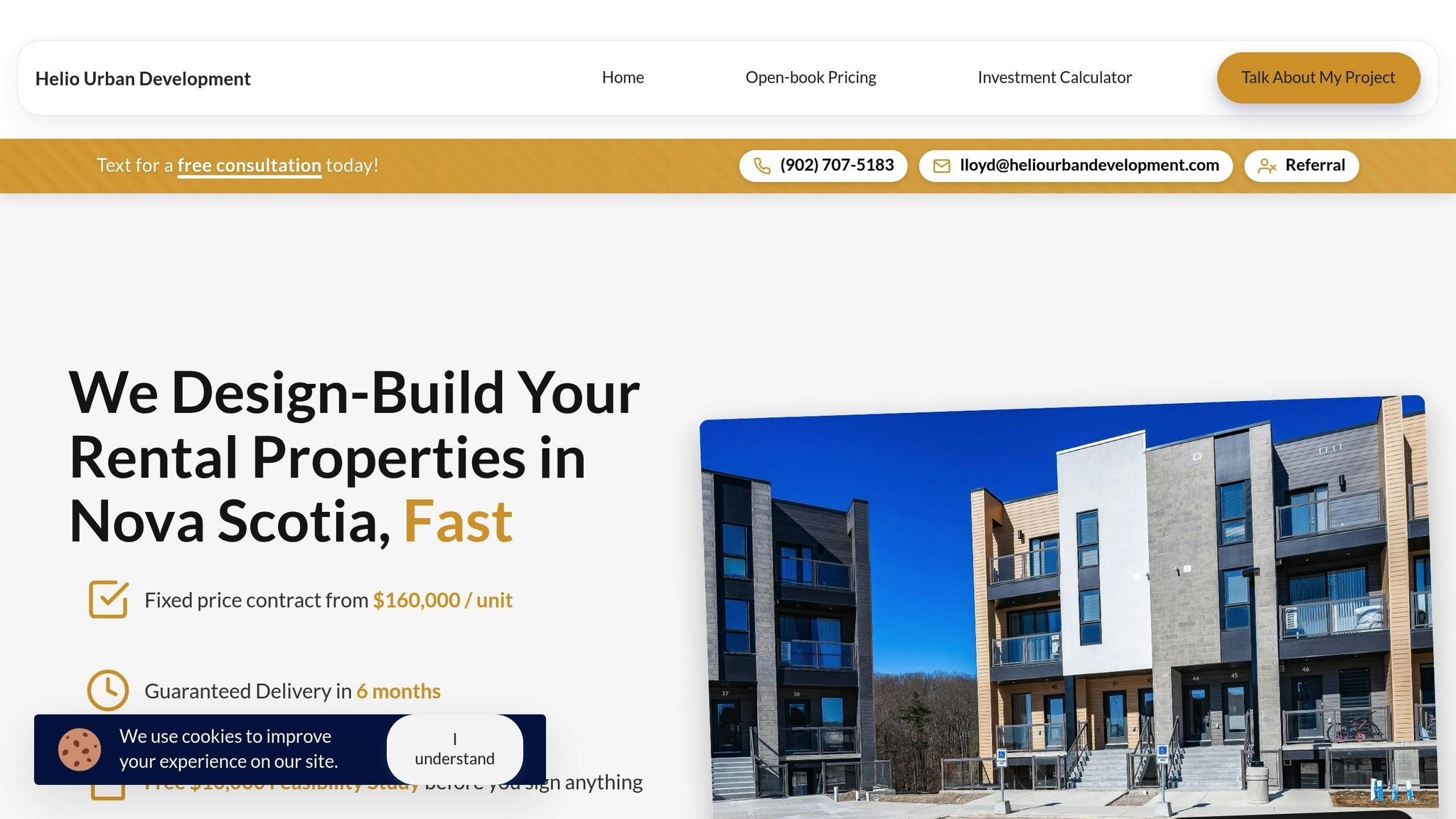

Case Study: Helio Urban Development’s Integrated Approach

Helio Urban Development provides a clear example of how the integrated design-build model addresses common construction challenges. Founders Lloyd Liu and Yuan He started the company after experiencing their own frustrations with traditional contractors. Their approach directly tackles the core pain points faced by property owners.

Fixed-price contracts are a hallmark of Helio’s process. At $160,000 per unit, these contracts eliminate budget uncertainty. Lloyd Liu, leveraging his investment banking expertise and experience managing over $30M in construction projects, personally reviews every quote. This meticulous process has resulted in zero cost overruns across the 31 units currently under construction.

Six-month construction guarantees ensure timely delivery. Helio uses advanced scheduling systems to prevent delays. If a project runs late, the company compensates property owners up to $1,000 per day, protecting the $8,800 monthly rental income typical of a fourplex.

Quality assurance is built into every stage of the process. Professional Engineers conduct inspections at five critical points during construction, and property owners can choose their own final inspector. This triple-check system ensures top-tier quality, backed by a two-year warranty, and avoids the disputes often seen in fragmented projects.

Daily photo updates and a real-time portal keep property owners informed throughout the process.

Steps for Property Owners to Build Profitable Rental Units

With the surge in demand for rental housing in Nova Scotia, property owners have a prime opportunity to develop profitable multi-unit properties. To succeed, careful planning is essential - timing, location, and design must align with tenant expectations and market trends. Here's a practical guide to help you make the most of this opportunity.

When to Start Your Construction Project

Timing can make or break your rental project. To maximize returns, aim to complete construction when rental demand is at its peak. In Nova Scotia, interprovincial migration typically increases during the summer, with rental interest climbing later in the season. Starting construction in the fall or early winter allows you to finish by spring, just in time for this high-demand period.

Speeding up construction can also help minimize financing costs, which can significantly impact your bottom line. Once your timeline is set, the next step is to choose a location that ensures steady tenant interest.

How to Pick High-Demand Locations

The location of your property plays a huge role in its long-term success. Areas with strong transit links and proximity to employment hubs tend to attract more tenants and maintain higher occupancy rates. In urban centres, neighbourhoods near business districts or vibrant downtown areas are particularly appealing.

If you're targeting student tenants, properties near universities and colleges can provide a reliable rental pool, though these areas may favour smaller units. Keep an eye on infrastructure upgrades, such as new transit lines or urban revitalization projects, as they can signal emerging opportunities. Additionally, focusing on municipalities with consistent population growth can help ensure long-term rental demand.

Once you've nailed down the timing and location, it's time to turn your attention to the details that make a property stand out.

Design and Energy Features That Attract Tenants

Modern tenants are increasingly drawn to energy-efficient and thoughtfully designed living spaces. Features like triple-pane windows and efficient climate control systems not only reduce utility costs but also enhance comfort - two factors that tenants value highly.

Smart home technologies are another big draw. Keyless entry, programmable thermostats, and video doorbells add convenience and security, making your property more appealing while simplifying management. On the aesthetic side, high-end finishes such as quartz countertops and hardwood floors create a polished, upscale feel and often reduce long-term maintenance costs.

Amenities also play a key role in minimizing vacancy rates. By combining energy efficiency with stylish, tenant-friendly designs, you can boost rental income while increasing the overall value of your property.

Conclusion: Acting on Nova Scotia's Housing Opportunity

Nova Scotia's housing market is experiencing a surge in demand, fuelled by steady interprovincial migration. With more new residents looking for rental housing, property owners have a prime chance to invest in profitable multi-unit rental properties. To make the most of this opportunity, a well-thought-out construction strategy is essential - one that reduces risks while boosting potential returns.

Multi-unit rentals in the province currently generate between $1,950 and $2,100 per unit monthly, translating to annual returns of 12% to 20%. This growth isn't just a passing phase. It's part of a larger demographic shift that's creating sustained demand for rental housing across Nova Scotia.

The path to success lies in selecting the right construction method. A fragmented construction process - relying on multiple contractors with unpredictable costs and timelines - can significantly eat into profits. On the other hand, an integrated design-build model provides a more reliable solution. Take the Adsum Sunflower development as an example: it was completed in just eighteen months, with the design and construction planning wrapped up in only six months [1]. This approach encourages close collaboration between design and construction teams, helping to streamline decision-making and avoid delays or conflicts during the project [1].

The benefits of an integrated design-build approach are clear: fixed-price contracts, guaranteed timelines, and designs tailored to attract high occupancy rates, premium rents, and lower maintenance costs [1].

The time to act is now. Delaying could mean facing stiffer competition and rising construction costs. As more property owners move to secure prime locations, the market will only grow tighter. With the right timing and a trusted construction partner, property owners can turn this housing demand into a sustainable and profitable investment.

For those ready to take the leap, partnering with experienced professionals who deliver on-time and on-budget construction is critical. With the right team, a strategic location, and careful planning, you can turn Nova Scotia's housing boom into a long-term venture that aligns with your financial goals while contributing to the community's housing needs.

FAQs

Why are so many people moving to Nova Scotia, and what impact is this having on the housing market?

Nova Scotia has been seeing a surge in population, fuelled by people relocating from other provinces and international immigrants choosing to settle there. This influx is largely attributed to the province's relatively affordable cost of living, appealing lifestyle, and expanding job prospects in key industries.

With more people calling Nova Scotia home, the demand for housing - particularly multi-unit rental properties - has skyrocketed. This growing need has led to a housing shortage, tightening the rental market. For property owners, this presents a timely chance to invest in new rental developments to address the growing demand.

What are the benefits of investing in multi-unit rental properties in Nova Scotia, and what kind of financial returns can property owners expect?

Investing in multi-unit rental properties in Nova Scotia presents a promising opportunity, thanks to the increasing demand for housing fuelled by population growth and migration. Property owners in this market can benefit from consistent rental income and attractive returns, particularly in sought-after areas like Halifax and Dartmouth.

Here’s a snapshot of potential financial returns based on property type:

- Duplexes: In Halifax, cap rates generally fall between 5.50% and 6.25%.

- Triplexes: In areas like Dartmouth, monthly rental income often starts around $2,800.

- Fourplexes: Properties in prime locations can bring in more than $10,000 in rental income each month.

- Small Apartment Buildings (5–12 units): Average monthly rents per unit in Halifax range from $1,370 to $1,922.

- Mixed-Use Properties: These properties offer a mix of income sources, with potential returns between 8% and 12% ROI.

By choosing the right location and timing, investors can tap into Nova Scotia’s expanding rental market while addressing the housing demands of its growing population.

What are the benefits of choosing an integrated design-build approach for rental property construction?

An integrated design-build approach simplifies the construction process by merging the design and construction phases into one seamless workflow. This setup encourages better communication and teamwork among everyone involved, helping decisions get made faster and resolving issues more efficiently.

This approach can cut down on both time and costs by tackling potential challenges early on. With a unified team working together, risks are minimized, and projects are more likely to stay within budget and on schedule. For property owners, it offers a smoother process and added peace of mind in reaching their rental property goals.