Bonus zoning in Nova Scotia allows developers to exceed standard density limits in HR-1 (High-Density Residential) and CEN-2 (Centre Designation) zones for projects over 2,000 m² of floor area. In exchange, developers must provide public benefits, such as contributions to affordable housing, park upgrades, or community spaces. Here's what you need to know:

- Eligibility: Applies to HR-1 and CEN-2 zones for projects exceeding 2,000 m².

- Public Contribution: 20% of the floor area beyond 2,000 m² is calculated into a mandatory contribution.

- 60% must go towards affordable housing (cash).

- 40% can fund other community benefits like public art or green space improvements.

- Development Types: Multi-unit residential and mixed-use buildings often qualify.

- Benefits: Additional density allows for more units or height, increasing rental income potential.

For example, a 15,000 m² project would require a $485,550 public contribution, split between housing and other benefits. Early planning and negotiations with municipal staff are key to streamlining the approval process. Bonus zoning is mandatory in CEN-2 zones for projects exceeding standard limits.

Requirements for Bonus Zoning

Basic Requirements for Bonus Zoning

To qualify for bonus zoning, a project must have a floor area exceeding 2,000 m² and be located in an eligible zone. These zones include HR-1, CEN-2, DD, DH, CEN-1, COR, HR-2, Future Growth Nodes, or areas covered by Development Agreements [1]. If a project measures exactly 2,000 m² or falls outside these zones, it does not qualify.

The public contribution requirement is calculated as 20% of the floor area beyond 2,000 m², multiplied by the applicable density bonus rate [1]. At least 60% of this contribution must be allocated as cash for affordable housing. The remaining 40% can support other public benefits, such as heritage conservation, park upgrades, community spaces, or public art [1].

Development Types That Qualify

Multi-unit residential developments with four or more units often meet the floor area threshold, making them eligible. These projects not only qualify for bonus zoning but also help boost unit availability and rental income.

Mixed-use developments can also qualify, provided the combined floor area of their residential and commercial (or community) components meets the 2,000 m² minimum.

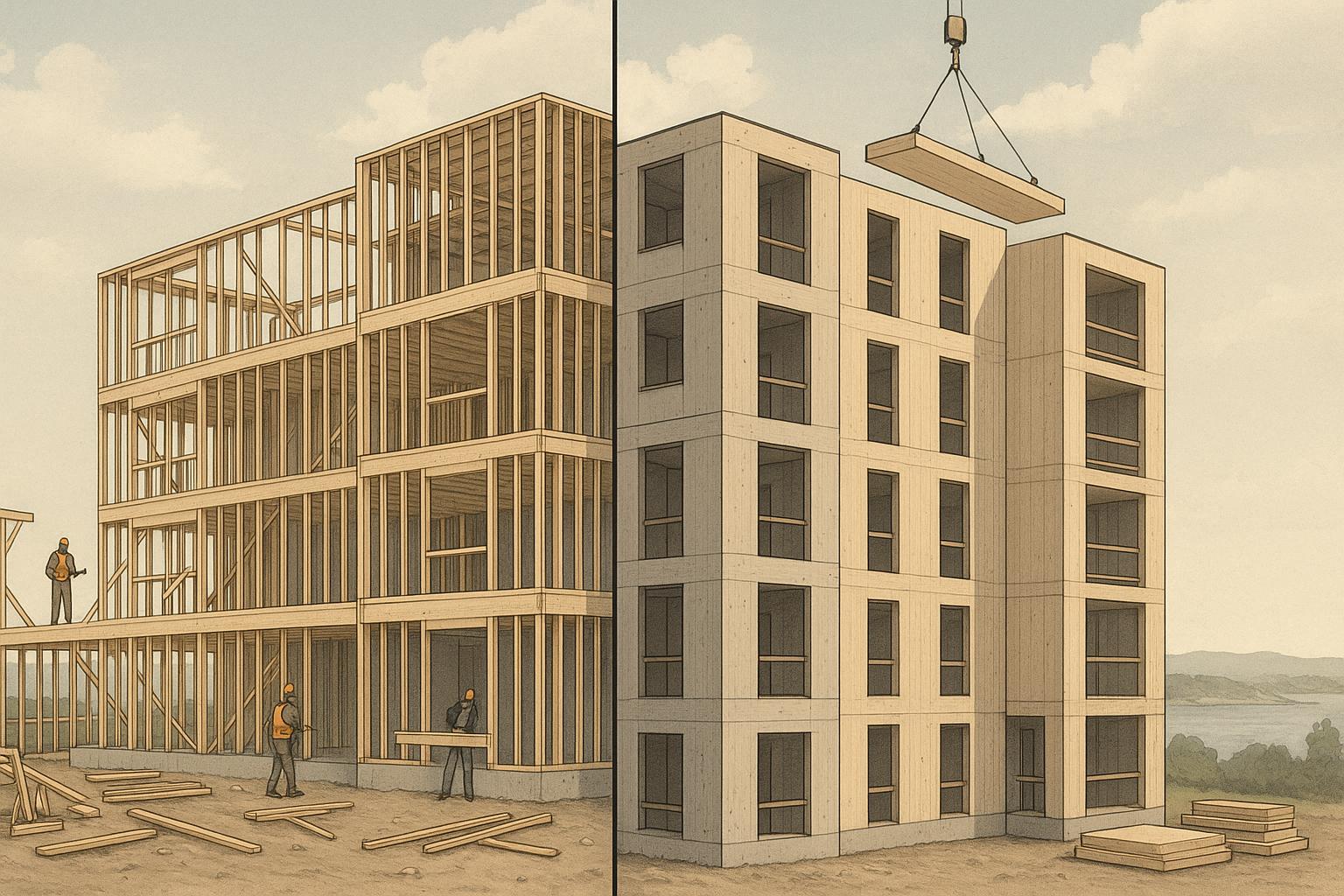

New construction projects are typically the most straightforward candidates for bonus zoning. However, renovations and additions may also qualify if the total finished project exceeds 2,000 m². In these cases, only the new floor area above the threshold is considered in the bonus calculation.

To move forward, property owners must apply for a bonus zoning agreement and commit to the required public benefit as part of the site plan approval process [1].

Exemptions and Special Cases

Projects under 2,000 m² or those located outside eligible zones are not eligible for bonus zoning. These limitations ensure that the program targets larger-scale developments in designated areas.

Community Benefits and Developer Obligations

Types of Community Benefits

Bonus zoning in HR-1 and CEN-2 creates a win-win scenario: developers gain additional density, while communities receive targeted improvements. In return for this increased density, property owners commit to providing benefits that enhance neighbourhood quality and promote inclusivity. These benefits might include contributions to affordable housing, upgrades to green spaces, new community facilities, or improvements to local infrastructure. The exact benefits required will depend on the community's planning goals and the specifics of your project. Once these priorities are identified, the next step is to work with local officials to negotiate the terms.

How to Negotiate and Provide Benefits

Start discussions with municipal planning staff early in the process. Reviewing the local community plan can help you identify key priorities, such as affordable housing needs or green space improvements. Submitting your proposed benefits early allows time for feedback, which can simplify the approval process. Be sure to include detailed documentation of your plans, including cost estimates and timelines, to clearly outline your commitments.

Impact on Project Costs and Timeline

While community benefits can add to project costs and extend timelines, the additional density often offsets these expenses by improving the project's overall feasibility. Careful planning and realistic budgeting for these commitments are essential to keeping your development on track and within budget. By understanding and addressing these factors early, you can align bonus zoning requirements with a smooth and efficient project delivery, all while contributing valuable improvements to the community.

How Bonus Zoning Affects Multi-Unit Rental Development

Adding More Units and Height

Bonus zoning allows developers to go beyond standard density restrictions, making it possible to include more units, increase building height, or add extra floor area. In HR-1 and CEN-2 zones, this zoning tool is particularly useful for projects that surpass the 2,000-square-metre threshold, as outlined in the requirements section. Essentially, bonus zoning can significantly expand a building’s residential capacity compared to what’s allowed under standard zoning rules.

Higher Rental Income and ROI

With greater density comes the potential for higher rental income. Bonus zoning can be a game-changer when you consider the revenue from additional units. In Nova Scotia’s current rental market, each bonus zoning unit can generate monthly rents ranging from $1,950 to $2,100. For instance, adding just two units could bring in roughly $46,800 to $50,400 annually. Even after factoring in the costs tied to community benefits, many property owners find their overall returns surpass the typical 12–20% annual ROI, making it a financially appealing option.

Benefits of Integrated Design-Build Methods

Maximizing the advantages of bonus zoning often hinges on efficient project management. An integrated design-build approach brings all stakeholders together from the start, promoting collaboration and resolving potential issues early. This not only saves time and money but also reduces the likelihood of costly change orders. By consolidating accountability under one team, the design-build method streamlines the entire process - from planning and benefit documentation to construction preparation. This approach ensures quicker decisions and more cost-effective outcomes, which is especially beneficial for multi-unit rental developments where efficiency and budget control are critical.

sbb-itb-16b8a48

Step-by-Step Guide: Using Bonus Zoning for Your Project

Step 1: Check Zone and Eligibility

Start by confirming your property’s zoning designation through Centreplan.ca, referencing the Centre Plan and Land Use By-law. Your eligibility for bonus zoning depends on your zone classification.

For HR-1 zones, focus on properties near transit, services, and employment hubs. These zones are suited for multi-unit residential buildings ranging from 4 to 12 storeys, designed to blend with nearby residential areas. Bonus zoning here applies to projects exceeding standard floor area thresholds.

CEN-2 zones, on the other hand, are high-intensity development areas, often along major streets or next to other Centre-zoned properties. These zones allow for mixed-use buildings from mid-rise to high-rise, reaching heights of up to 90 metres (approximately 29 storeys). Unlike HR-1 zones, bonus zoning in CEN-2 zones is mandatory for projects seeking to exceed standard regulations.

To qualify for bonus zoning in either zone, your project must exceed 2,000 m² of total floor area. This includes the entire building’s floor area, not just the additional space you're requesting.

Once you’ve confirmed eligibility, the next step is calculating your project’s bonus zoning potential.

Step 2: Evaluate Bonus Zoning Potential

Determine the financial impact of bonus zoning by calculating the required public contribution. Use this formula: subtract the standard floor area threshold from your total proposed floor area, take 20% of the remaining area, and multiply it by your district’s density bonus rate.

Here’s an example: For a 15,000 m² building, subtract the 2,000 m² threshold to get 13,000 m². Take 20% of that (2,600 m²) and multiply it by the bonus rate of $186.75. This results in a public contribution of $485,550.

Next, allocate the contribution:

- 60% ($291,330) goes towards affordable housing (cash).

- 40% ($194,220) is for other public benefits, such as heritage building conservation, municipal parks, affordable community or cultural indoor spaces, or public art (either on-site or as a cash alternative).

Assess how this contribution impacts your return on investment (ROI). For instance, with rental units generating $1,950 to $2,100 per month, the added density often offsets the public contribution costs. Efficient construction methods can further help control project expenses, improving overall profitability.

Once you’ve calculated the costs and benefits, you’re ready to formalize and negotiate your bonus zoning terms.

Step 3: Apply and Negotiate Terms

Using your calculations and proposed community benefits, submit a density bonus agreement with all required documentation. This agreement will be reviewed by a Development Officer, so ensure it clearly outlines the community benefits and demonstrates how they align with municipal priorities.

When deciding how to allocate the 40% discretionary public contribution, think about benefits that add value to your project and the surrounding neighbourhood. On-site public art can boost your building’s appeal, while heritage conservation contributions preserve local character. Contributions to municipal parks are often well-received, especially in areas where green space is scarce.

Work closely with municipal planning staff to identify benefits that align with local needs. An integrated design-build approach can simplify this process, as having your planners, architects, engineers, and construction team collaborate ensures consistent documentation and quicker decision-making.

To avoid delays, submit your proposal early and ensure it’s complete. Clear communication and thorough preparation can help streamline the approval process, keeping your project on schedule and allowing you to start generating rental income as planned.

How to Quickly Look Up Zoning in Halifax, Nova Scotia

Key Points About Bonus Zoning in HR-1 and CEN-2

Here’s a breakdown of how bonus zoning works in HR-1 and CEN-2 zones:

Bonus zoning in these areas allows property owners to boost project density by committing to specific public benefits. The required contribution is calculated as 20% of the floor area exceeding 2,000 m², multiplied by the applicable density bonus rate[1]. This contribution is divided between affordable housing and other community benefits.

For those planning multi-unit rental projects, bonus zoning offers an opportunity to increase development capacity, potentially improving the overall financial viability of the project. The value of public benefit contributions is tied to updated local land values[1]. For detailed steps on the approval process, consult the Step-by-Step Guide.

To make the most of bonus zoning, property owners should confirm their eligibility early, carefully assess the financial implications of the contributions, and work with experienced professionals to navigate the approval process smoothly. These steps can help maximize development potential and rental income.

FAQs

How does bonus zoning in HR-1 or CEN-2 zones affect the budget for a development project?

Bonus zoning in HR-1 (High-Density Residential) and CEN-2 (Centre Designation) zones can have a notable impact on your development costs, especially when your project surpasses specific thresholds. For instance, in HR-1 zones, if the gross floor area (GFA) of your development goes beyond 2,000 m², you’ll be required to make a public contribution. This typically involves funding initiatives like affordable housing or community amenities. The contribution amount is determined as 20% of the GFA that exceeds the 2,000 m² limit.

These additional costs can affect both the feasibility and profitability of your project. To stay on track, it’s crucial to factor them into your budget from the outset. By planning ahead, you can ensure your development meets zoning regulations while staying financially sustainable.

How can property owners negotiate community benefits under bonus zoning in HR-1 and CEN-2 zones?

To navigate community benefit negotiations under bonus zoning in Nova Scotia's HR-1 or CEN-2 zones, start by carefully examining the local zoning bylaws. These bylaws outline the public benefits required in exchange for increased density, which could include things like affordable housing, public green spaces, or other community amenities.

It’s important to engage early with municipal officials and community members. By identifying shared priorities and understanding local needs, you can ensure your proposal aligns with what the community values most. When preparing your proposal, make it clear and detailed - lay out the scope, costs, and anticipated benefits of your contributions to streamline discussions and avoid misunderstandings.

Lastly, make sure the agreement is formalized through municipal council approval. This step ensures compliance with local policies and makes the agreement legally binding. Taking a proactive, open, and cooperative approach can help you achieve your development goals while also addressing community interests, creating a balanced and beneficial outcome for everyone involved.

Can renovations or expansions of existing buildings qualify for bonus zoning, and how is the bonus amount determined?

Existing buildings in Nova Scotia can take advantage of bonus zoning during renovations or expansions, provided the project exceeds the exemption threshold - typically 2,000 m². The bonus is determined by calculating 20% of the additional floor area beyond this threshold and multiplying it by the local bonus rate.

From the total bonus contribution, 60% is dedicated to affordable housing, while the rest goes toward other community benefits. This system not only encourages higher density but also aligns with broader goals for community growth and development.

Related Blog Posts

- Halifax’s New Zoning Rules Explained: Up to Four Units on a Single Lot (What It Means for Builders)

- HR-1 (HR1) Zoning Halifax: 3–6 Storeys and Neighbourhood Transitions

- HR-1 (HR1) SPA Roadmap: Submission Stack, Studies, and Review Gates

- CEN-2 (CEN2) Incentive/Bonus Zoning: Contribution Math and Negotiation Tactics