Fixed-price contracts are the safer choice for property owners in Nova Scotia. They lock in your construction costs upfront, shielding you from unexpected price increases in materials or labour. In contrast, cost escalation clauses pass these rising costs directly to you, creating financial uncertainty and potential budget overruns. Here’s what you need to know:

- Fixed-Price Contracts: Offer predictable costs, easier financing, and penalties for delays. Builders absorb the risk of price increases.

- Cost Escalation Clauses: Shift cost risks to you, with potential budget overruns of 30–60%, making financing and cash flow planning more difficult.

- Integrated Builders: Companies like Helio Urban Development streamline the process by handling design, engineering, and construction under one contract, ensuring cost and timeline guarantees.

If staying within budget and avoiding financial surprises are your priorities, fixed-price contracts, especially with integrated builders, provide the clarity and control you need.

Cost Escalation Clauses: How They Work and What They Cost You

What Cost Escalation Clauses Mean

Cost escalation clauses allow contractors to adjust prices if there are changes in material costs, labour rates, or other market factors during the construction process. In Nova Scotia's multi-unit construction market, these clauses give contractors the flexibility to reflect shifting market conditions throughout the project. While they may protect contractors from unexpected cost increases, they can create significant financial challenges for property owners.

Financial Risks for Property Owners

For property owners, these clauses bring a level of financial unpredictability. Since any cost increases are passed on to you, it can throw off budget planning and disrupt financing arrangements. This is especially concerning in Nova Scotia, where construction loans are often tied to a pre-approved budget. If costs rise unexpectedly, you may need to revisit your financing plan, potentially requiring additional funds to keep the project on track.

How Cost Changes Affect Your Financing

These potential cost adjustments highlight the importance of thoroughly understanding your contract before construction begins. Exploring alternative contract options that provide more stable pricing could help you avoid surprises and maintain better control over your project's financial outlook.

Fixed-Price Contracts: Locked Costs and Budget Certainty

How Fixed-Price Contracts Work

Fixed-price contracts set your total construction cost upfront, before any work begins on your multi-unit property. This means that once the contract is signed, the agreed-upon cost remains unchanged, even if material or labour prices increase during construction. Essentially, the builder takes on the risk of any cost overruns, not you.

To make this work, builders must carefully calculate all project costs in advance. They also include contingencies to account for potential market fluctuations. This approach ensures that you’re protected from unexpected price hikes while giving the builder the responsibility to manage costs effectively.

For fixed-price contracts to succeed, every detail of the project must be clearly outlined in the agreement. This includes material choices, fixture selections, and construction specifications. By defining the scope of work upfront, you avoid misunderstandings or additional costs later. This clarity not only keeps your project on track but also provides the peace of mind that comes with predictable budgeting and financing.

Why Property Owners Prefer Fixed Pricing

The predictability of fixed pricing is a major draw for property owners, especially those developing multi-unit rental properties. When your total construction cost is locked in, you avoid budget surprises that could disrupt your financing plans. For example, if your construction loan is approved based on a specific budget, unexpected cost increases could create financial headaches. Fixed pricing eliminates this risk, keeping your loan and overall financial plan intact.

This stability also helps property owners accurately project rental income. For instance, if you’re building a fourplex at $160,000 per unit, your total investment will be $640,000 (excluding land costs). Knowing this figure upfront allows you to calculate potential returns with confidence, such as targeting a 12% to 20% ROI.

Construction lenders in Nova Scotia typically require detailed cost breakdowns and tie loan advances to specific project milestones. Fixed-price contracts give lenders the certainty they need to approve financing without requiring extra contingency funds. This makes the loan process smoother for property owners.

Another benefit is simplified cash flow planning. With your costs locked in, you can coordinate construction loan draws, plan permanent financing, and schedule rental marketing activities with a clear timeline and budget in mind. This level of predictability ensures you’re financially prepared at every stage of the project.

What Makes Fixed-Price Contracts Work

The success of a fixed-price contract hinges on the builder’s ability to estimate costs accurately and manage subcontractors efficiently. Builders need strong relationships with suppliers and trades to secure stable pricing, even in fluctuating markets.

To avoid scope creep and maintain budget stability, every detail of the project must be finalized before the contract is signed. If changes are needed after the agreement is in place, they typically require formal amendments with clearly defined additional costs.

Integrated construction companies often excel at delivering fixed-price contracts. By managing design, engineering, and construction under one roof, they can better anticipate potential challenges and control costs. This streamlined approach reduces the risk of miscommunication and cost overruns, which are common in more fragmented construction methods.

The financial health of your builder is another critical factor. A financially stable company can absorb unexpected costs without compromising the quality or timeline of your project. Many builders even include penalties for missing deadlines, reinforcing their commitment to delivering on their fixed-price promises.

Cost Escalation vs Fixed Price: Direct Comparison

Contract Type Comparison Chart

The differences between cost escalation clauses and fixed-price contracts become much clearer when you look at them side by side. Here's a comparison of key factors for each type of contract:

| Factor | Cost Escalation Clauses | Fixed-Price Contracts |

|---|---|---|

| Budget Predictability | Final costs can vary, with potential overruns of 30–60% | Pricing is locked in, avoiding cost overruns |

| Financial Risk | The property owner takes on the risk of cost increases | The builder absorbs any cost fluctuations |

| Financing Impact | May need additional loan contingencies | Easier lender approval with a clear cost breakdown |

| Timeline Control | Projects may extend to 12–18 months | Completion is faster, sometimes within 6 months, with guarantees and penalties |

| Owner Oversight | Requires constant monitoring of costs and adjustments | Minimal involvement after signing the contract |

| Cash Flow Planning | Payment schedules are unpredictable | Payments follow pre-set milestones |

| Change Order Frequency | Frequent revisions throughout the project | Changes are formalized through contract amendments |

| Penalty Structure | Builders aren’t held accountable for delays | Penalties for delays, often up to $1,000 per day |

This comparison shows why fixed-price contracts are often preferred by property owners, especially for multi-unit rental projects. For instance, if you plan to charge between $1,950 and $2,100 per month in rent per unit, even small delays or unexpected cost increases can significantly affect your return on investment.

Budget control is one of the most important distinctions. With cost escalation clauses, a fourplex project initially budgeted at $640,000 could end up costing around $832,000 - a 30% increase - if material prices spike. On the other hand, fixed-price contracts ensure your costs remain steady at $160,000 per unit, no matter how the market shifts.

Risk allocation is another critical difference. Escalation clauses place the burden of rising costs on you, the property owner. Fixed-price contracts shift that burden to the builder, who is often better equipped to handle cost changes through established supplier relationships and efficient processes.

This side-by-side comparison makes it clear why fixed-price contracts are the go-to choice for those who prioritize predictable budgeting.

Which Contract Type to Choose

The decision between these two contract types depends on your priorities, especially when it comes to managing your budget and timeline. Fixed-price contracts are ideal if you want to avoid financial surprises and ensure a predictable outcome.

For many, fixed pricing simplifies the process of securing construction financing. The risks tied to unexpected cost increases or delays can quickly overshadow any potential savings from cost escalation clauses. Fixed-price contracts not only lock in your budget but also transfer the financial risks to the builder, giving you peace of mind.

Delays can be costly, particularly for rental projects. For example, a three-month delay in completing a fourplex could result in $23,400 in lost rental income. Penalty clauses in fixed-price contracts help protect against this kind of loss.

If you’re aiming for a 12–20% annual return on investment, fixed-price contracts offer the stability and cost certainty needed to achieve your financial goals in multi-unit construction projects.

sbb-itb-16b8a48

Construction Contracts: Fixed Priced OR Cost Plus

Integrated Construction: Reducing Budget Risks Through Single Accountability

Budget risks in multi-unit construction often arise from poor coordination among separate contractors. When different companies handle design, engineering, and construction, misalignments can lead to costly delays and redesigns.

Traditional Construction vs. Integrated Delivery

Traditional construction usually follows the Design-Bid-Build model. In this setup, an architect is hired first, followed by engineers and then a general contractor. Each operates under separate contracts and timelines, creating multiple opportunities for budget overruns.

"Under the Design-Build model, the government business owner contracts for both design and construction from one firm, and the contractor hires a design consultant who works hand-in-hand on both the design and construction. This reduces the owner's exposure and risk associated with design errors and omissions, as well as creating a single point of responsibility."

A 2019 audit of city construction procurements revealed that design errors and omissions caused 51% of change orders in traditional projects [1]. In contrast, integrated delivery consolidates design, engineering, permitting, and construction under a single contract. This unified approach eliminates coordination challenges that often result in higher costs.

Fragmented setups often lead to expensive redesigns, delays, and disputes. For example, such issues can add an average of $47,000 in unexpected costs to a fourplex project.

"Integrated Project Insurance offers a client the opportunity to create a holistic and integrated team, eliminating the 'blame/claim' culture within a project. The innovative project insurance package that is built around the design fosters joint ownership of risk, reduces the likelihood of overrunning on cost and time, and limits the individual risk to members of the team."

This shift toward unified accountability creates the foundation for an effective fixed-price solution.

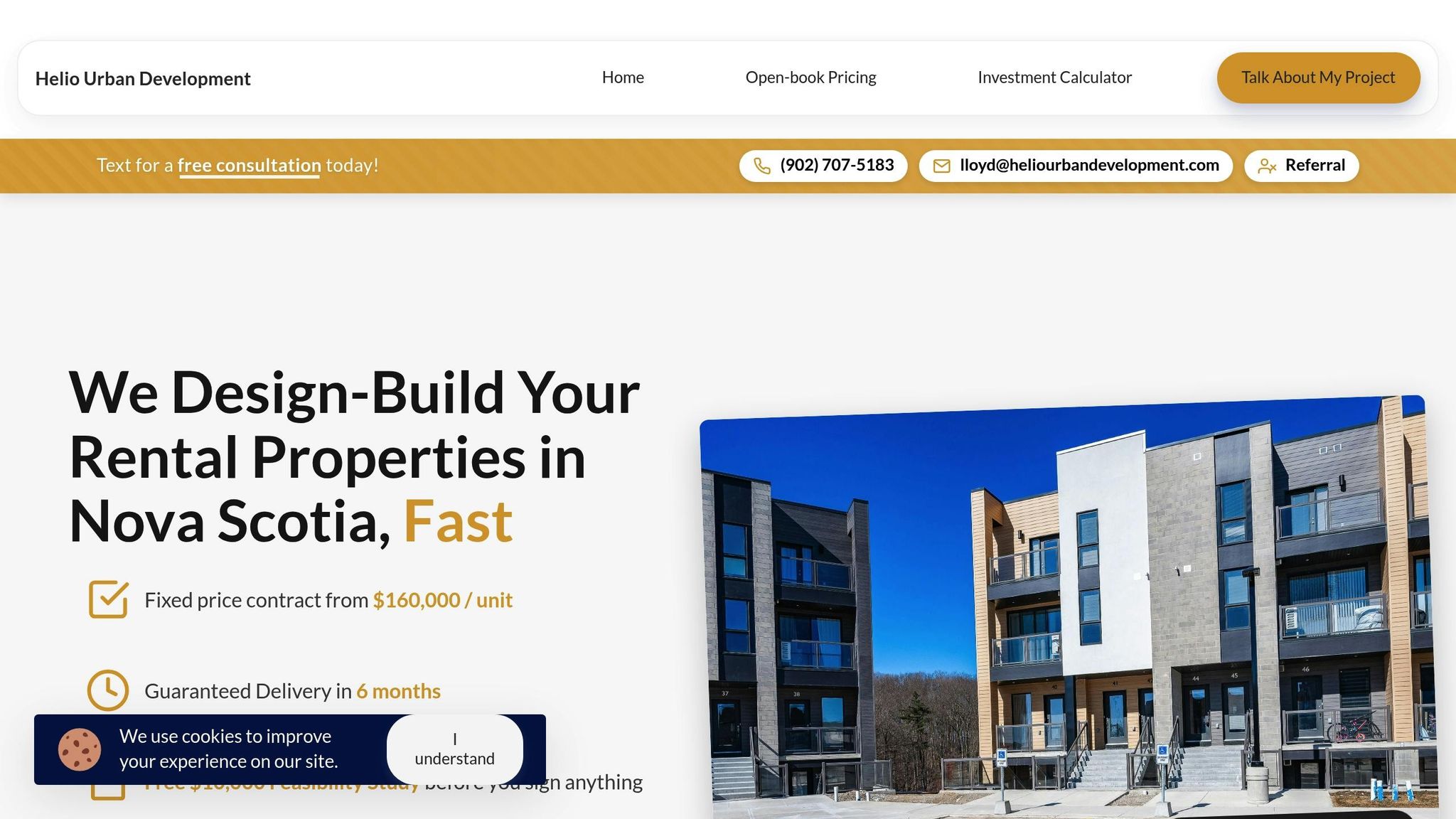

Helio Urban Development's Fixed-Price Model

Helio Urban Development is a prime example of the benefits of integrated construction. As Nova Scotia's only integrated design-build company specializing in multi-unit rental properties, Helio aligns all project phases under one contract, significantly reducing budget risks for property owners.

Their fixed-price model offers construction costs of $160,000 per unit, backed by a six-month timeline guarantee. To ensure accountability, penalties of up to $1,000 per day are enforced for delays.

This approach prevents the unnecessary delays common in traditional setups, where projects that should take 8 months can stretch to 18 months or more due to siloed work. Helio’s system ensures all teams collaborate from the start, streamlining the process.

Currently, Helio has 31 units under construction across Nova Scotia, with plans for 131 more within a 90-minute radius of Halifax. Their track record of zero cost overruns on completed projects underscores the reliability of integrated delivery.

Co-founder Lloyd Liu, a former Merrill Lynch investment banker with over $30 million in construction projects under his belt, personally guarantees project timelines. Meanwhile, Yuan He, his partner and a data scientist from the University of Pennsylvania, developed a scheduling system that minimizes delays.

For property owners aiming for monthly rents between $1,950 and $2,100 per unit, Helio’s integrated model ensures the budget certainty needed to achieve annual returns of 12–20%. With fixed costs and guaranteed timelines, planning financing and rental income becomes far more predictable.

The key advantage is single accountability. Instead of juggling multiple independent contractors, property owners work with one company responsible for everything - from permits to final inspection. By consolidating responsibilities, integrated models not only streamline project delivery but also ensure the fixed-price contract delivers on its promise of budget certainty.

Choosing the Right Contract to Protect Your Budget

Fixed-price contracts with integrated builders offer the strongest protection for your budget. These contracts focus on guaranteed pricing and single accountability, aligning perfectly with the integrated construction model mentioned earlier.

When selecting a builder, prioritize those with a proven track record of delivering projects on time and within budget. Builders who can show zero cost overruns on completed projects demonstrate their ability to price accurately and manage risks effectively - two critical factors for staying within budget.

Opt for builders who handle design, engineering, and construction under a single contract. This approach eliminates the blame game that often leads to escalating costs when unexpected issues arise. By consolidating responsibilities, you transfer the cost risks from yourself to the builder, safeguarding your investment.

Financial stability is another key consideration. Confirm that the builder has the financial resources to back delay penalties. Reliable fixed-price contracts often include penalties for delays and cost overruns. For instance, Helio Urban Development offers property owners up to $1,000 per day for construction delays - a clear sign of their confidence in meeting deadlines and budgets.

Take a close look at the builder's scheduling and project management methods. Builders who consistently meet deadlines rely on advanced scheduling systems, not just optimistic projections. This level of organization ensures that timelines are realistic and achievable.

If you're planning a multi-unit rental property, choosing a builder with expertise in these types of projects is essential. Multi-unit properties have unique requirements compared to single-family homes or commercial buildings. Builders experienced in this niche understand the specific needs of property owners, such as rental market demands and financing considerations, giving you an added layer of assurance.

Finally, assess the builder's transparency and communication systems. Builders who provide daily updates and clear progress reports allow you to monitor the project closely. This visibility helps you catch potential issues early, preventing costly surprises down the line.

While fixed-price contracts with integrated builders may come with a higher upfront cost, they eliminate change orders and delays, offering you the certainty and peace of mind that your budget will remain intact.

FAQs

What financial risks could property owners in Nova Scotia face with contracts that include cost escalation clauses?

Property owners in Nova Scotia who choose contracts with cost escalation clauses might face unexpected cost increases if material prices go up during construction. These clauses give contractors the ability to pass on extra expenses, which can make it difficult to stick to a predictable budget.

For multi-unit rental property projects, this kind of unpredictability can put pressure on financial planning and even affect the overall return on investment. To better protect your budget, you might want to explore whether a fixed-price contract could provide more stability and reassurance.

Why do fixed-price contracts offer better budget certainty than contracts with cost escalation clauses in multi-unit construction projects?

Fixed-price contracts offer a clear advantage when it comes to managing your budget. By locking in the total project cost from the start, you’ll know exactly what you’re paying, leaving no room for surprises. This type of agreement shifts the risk of unexpected cost increases - like higher material prices or rising labour rates - onto the contractor instead of you.

On the other hand, contracts with cost escalation clauses allow for price adjustments as the project progresses. While this flexibility might seem appealing, it can lead to unplanned expenses and make it harder to keep your budget on track. For property owners in Nova Scotia, particularly those overseeing multi-unit rental developments, fixed-price contracts provide a dependable way to protect your investment and steer clear of financial uncertainty.

How does an integrated construction approach help fixed-price contracts provide better budget stability?

An integrated construction approach brings a sense of reliability to fixed-price contracts by uniting all parts of the project under a single team. This setup promotes collaboration, reduces the chances of miscommunication, and shifts the financial risks to the contractor, offering property owners much-needed peace of mind.

By simplifying workflows and encouraging efficient resource management, this method helps cut down on unexpected expenses and delays. For property owners, it means they can concentrate on bringing their vision to life without the stress of surprise costs. This makes it a smart choice, especially for multi-unit rental property construction projects in Nova Scotia.

Related Blog Posts

- Fixed-Price Construction vs. Traditional Building Contracts in Nova Scotia

- Nova Scotia Home Building Costs Guide 2025: Budgeting from Land Purchase to Move-In

- Staying on Schedule: How to Prevent Delays in Your Nova Scotia Home Build

- Avoiding Construction Delays in Nova Scotia: The Owner’s Critical Path Checklist