Yes, a 4‑plex in Halifax can generate positive cash flow under CMHC MLI Select, but success depends on careful planning. Here’s the breakdown:

- Cost: Building a 4‑plex compliant with MLI Select standards costs approximately $200,000 per unit due to energy-efficient and accessible features. For a total project cost of $800,000, the required down payment is just 5% ($40,000).

- Financing: With a 50-year amortization and premium discounts tied to energy efficiency and accessibility, mortgage payments remain low.

- Rental Income: At $1,950 per unit, gross monthly rent totals $7,800. After 30% operating expenses, there’s enough net income to cover mortgage payments.

- Challenges: Construction delays and cost overruns (common in Halifax) can erode profits. Rising interest rates and strict compliance requirements also add complexity.

- Solution: Opting for an integrated design-build approach minimizes delays and cost overruns, ensuring predictable timelines and budgets.

Bottom line: With Halifax’s strong rental demand and MLI Select’s favourable terms, a 4‑plex can deliver annual ROI between 12% and 20%, provided the project is executed with precision.

How Much Does My 4-Unit Rental Property Cash Flow?

Financial Analysis: Will a Halifax 4‑Plex Cash Flow Under MLI Select?

When structured well, a 4‑plex under CMHC's MLI Select program can generate positive cash flow. Let’s break down the numbers to see how this works.

Construction Costs for an MLI Select-Compliant 4-Plex

Building an MLI Select-compliant 4‑plex in Halifax costs about CAD $200,000 per unit, compared to CAD $160,000 per unit for standard construction. The higher costs stem from features like better energy efficiency and stricter compliance measures. However, the financing benefits offered under the program help balance these additional expenses.

Financing Structure and Terms

One of the key advantages of CMHC MLI Select is its favourable financing terms: 5% down payment and a 50-year amortization period, compared to the conventional 20% down payment and a 25-year amortization. For an CAD $800,000 project, the 5% down payment means an initial investment of CAD $40,000. While this results in a larger loan amount, the extended amortization reduces monthly payments, making the cash flow more manageable.

Rental Income and Operating Expenses

With rental income estimated at CAD $1,950 per unit, a 4‑plex generates approximately CAD $7,800 in gross monthly rent. Assuming operating expenses are 30% of gross income, the remaining net operating income is sufficient to cover mortgage payments.

Worked Example: Cash Flow Calculation

Here’s how the numbers look for an CAD $800,000 project:

- Down payment (5%): CAD $40,000

- Loan amount: CAD $760,000

The projected annual gross rental income is CAD $93,600, and after accounting for 30% operating expenses, the net operating income comfortably covers the mortgage payments. While the exact cash flow depends on interest rates, this structure shows potential for modest positive cash flow in the first year. Over time, increasing rents can further improve the financial picture.

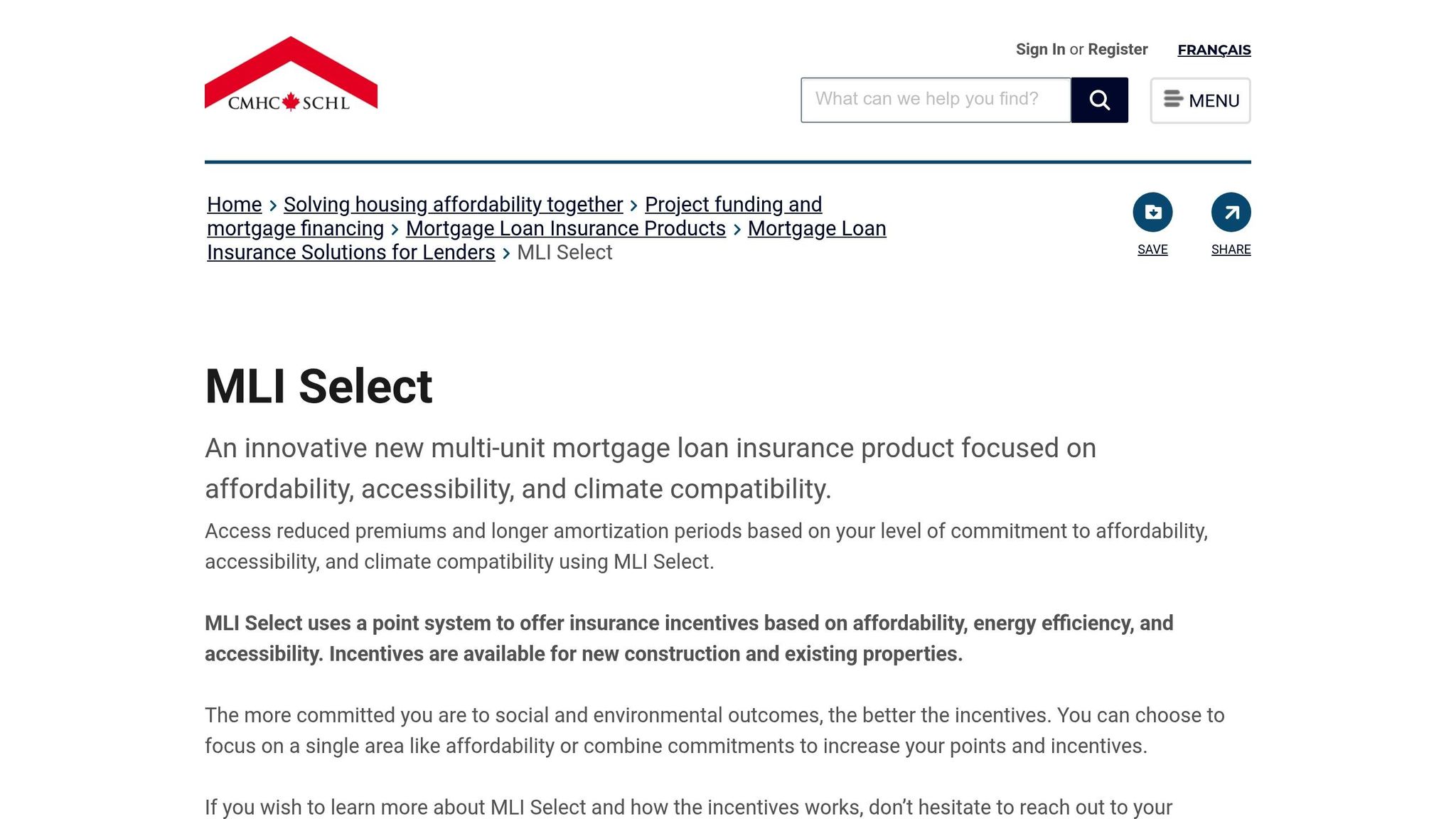

Understanding the CMHC MLI Select Points System

The MLI Select program uses a points-based system to encourage builders to include specific features in their projects. Grasping how this system works is key to qualifying for premium discounts and improving the financial performance of a project. The points not only determine eligibility for savings but also tie directly into the project's financing benefits.

How the Points System Works

CMHC evaluates projects based on three main categories: affordability, energy efficiency, and accessibility. Points are earned in each category, and projects must meet a minimum score to qualify for premium discounts.

- Affordability: Points are awarded when rents are capped below a certain percentage of the local median rent.

- Energy Efficiency: Projects that exceed basic building code standards by incorporating advanced energy-saving measures earn points. While these upgrades may increase upfront costs, they lead to long-term savings and better premium discounts.

- Accessibility: Features like barrier-free entrances, wider doorways, and other accessible design elements can significantly boost a project's point total.

Impact of Premium Discounts on Borrowing Costs

The points earned translate into mortgage insurance premium discounts, directly affecting a project's financing costs. CMHC offers discount tiers, with higher points leading to better savings. Projects that combine affordable rents, advanced energy efficiency, and comprehensive accessibility features are more likely to secure the most significant discounts. These savings improve cash flow by lowering overall borrowing costs.

Documentation and Compliance Requirements

To qualify for MLI Select, builders must provide detailed documentation and undergo third-party verification. This includes certified reports such as energy modelling, rent roll projections, and accessibility certificates, all of which are reviewed by CMHC during and after construction.

While this thorough documentation process can extend project timelines, it offers clarity around financing costs and reduces uncertainties often associated with construction. For Halifax 4-plex projects, this rigorous approach ensures a solid financial framework, helping to secure cash flow stability.

sbb-itb-16b8a48

Construction Approaches: Integrated Design-Build vs Fragmented Methods

When constructing a 4-plex under CMHC MLI Select, the method you choose can significantly influence your cash flow potential. The choice between an integrated design-build approach and fragmented construction methods often determines whether you'll stay on budget and on schedule - or face costly overruns and delays that could hurt your return on investment (ROI).

Key Differences Between Integrated and Fragmented Construction

Many Halifax property owners face the daunting task of managing multiple professionals - architects, engineers, contractors, and tradespeople - when building rental properties. This fragmented approach often results in coordination issues and budget overruns, which can range from 30% to 60%. Projects frequently run past their expected timelines. On average, property owners lose approximately $47,000 per project due to these inefficiencies.

In contrast, the integrated design-build method simplifies the process. By bringing architects, engineers, and construction teams together under one company, conflicts are resolved during the planning phase, not on-site. This streamlined approach minimizes waste, cuts costs, and keeps projects on track.

Here’s a clear breakdown of how the two methods compare:

| Aspect | Fragmented Construction | Integrated Design-Build |

|---|---|---|

| Contracts | 6+ separate contracts to manage | Single contract with one company |

| Cost Structure | Cost-plus with frequent overruns | Fixed-price with guaranteed costs |

| Timeline | 12–18 months | 6 months guaranteed |

| Accountability | Blame shifting among trades | Single point of responsibility |

| Coordination | Owner manages all trades | In-house coordination |

| Budget Certainty | Frequent change orders and surprises | Locked pricing before construction |

Common Construction Problems and Solutions

Timeline delays are a common issue in traditional construction methods. Poor scheduling, late material deliveries, and weather-related setbacks often snowball into significant delays when there’s no proper coordination.

Budget overruns are another major concern. For instance, an architect might design a plan that exceeds the budget, or engineers might specify materials that are hard to source locally. These missteps often lead to costly change orders during the build.

Quality issues can also arise when trades operate independently. For example, a mistake by one trade, like incorrectly installing a system, can interfere with another, causing delays and additional expenses to fix the problem.

Integrated construction addresses these challenges head-on. By coordinating teams during the planning stage, potential conflicts are resolved before construction begins. This proactive approach ensures that the fixed-price and timeline guarantees are met, avoiding the chaos of mid-project adjustments.

Benefits of Fixed-Price and Guaranteed Timelines

Staying on budget and on schedule is critical for maintaining predictable cash flow, especially under CMHC MLI Select financing. Fixed-price contracts provide cost certainty, which is essential for accurate financial planning, while guaranteed timelines ensure you start collecting rent as planned.

Some construction companies go a step further, offering financial penalties for delays - up to $1,000 per day - underscoring their commitment to meeting deadlines.

Quality guarantees further protect your investment. For example, a 2-year warranty on all work, combined with multiple quality checks by professional engineers, ensures your 4-plex performs as expected, aligning with your cash flow projections.

By combining fixed pricing with guaranteed timelines, integrated construction transforms what is often an unpredictable process into one that’s reliable and efficient. This is particularly important for meeting CMHC MLI Select’s strict documentation and compliance requirements.

For Halifax property owners, the advantages of integrated construction extend beyond quality assurance - they provide the stability needed to achieve strong cash flow and ROI targets.

Halifax-Specific Risks, Market Factors, and ROI Potential

Investing in a 4‑plex in Halifax under the CMHC MLI Select program comes with its fair share of challenges. From construction hiccups to market-specific pressures, these factors can directly influence your cash flow and overall returns. Let’s break down the key risks and opportunities unique to Halifax.

Construction and Financing Challenges

Construction in Halifax can be unpredictable. Fragmented coordination among trades often leads to cost overruns of 30% to 60%, not to mention delays that can stretch project timelines from 8 to 18 months. These inefficiencies can wreak havoc on your budget and scheduling.

Financing under CMHC MLI Select adds another layer of complexity. For example, a portion of your mortgage may be withheld until specific income targets are met, which could delay cash flow if occupancy falls short. While CMHC’s premium discounts can reduce borrowing costs, rising base interest rates may increase carrying costs during both construction and lease-up phases. Additionally, the extensive paperwork and compliance requirements mean that missing critical submissions could result in penalty rates or even force you to switch to costlier conventional financing.

Navigating Halifax’s Rental Market

Halifax’s rental market is a mix of opportunities and constraints. On the one hand, steady population growth - driven by local universities and interprovincial migration - creates strong demand for rental housing. On the other hand, local rent regulations can cap annual rent increases, limiting your ability to offset rising operating expenses.

Seasonal demand fluctuations also play a role. The academic year and summer months typically see higher rental activity, while winter can bring slower demand, requiring careful planning for potential vacancies. In this competitive market, modern MLI Select buildings with energy-efficient features often attract tenants willing to pay higher rents. However, older, well-maintained properties remain appealing to budget-conscious renters. These dynamics directly affect income potential and, ultimately, your return on investment.

ROI Potential for MLI Select 4‑Plex Projects

Despite the challenges, MLI Select 4‑plex projects in Halifax can deliver impressive returns, with annual ROI ranging from 12% to 20% on invested capital. This is largely due to financing options that allow up to 95% leverage with only a 5% down payment. Staying on budget and on schedule is key to achieving positive cash flow sooner rather than later.

Taking an integrated design-build approach can help minimize risks, reducing the likelihood of cost overruns and delays. Additionally, the availability of 50‑year amortization keeps mortgage payments manageable compared to rental income, which supports equity growth and long-term wealth-building.

When managed well, an MLI Select project in Halifax - combined with a keen understanding of local market trends and vigilant construction oversight - can offer a strong and rewarding investment opportunity.

Conclusion: Is Building a 4-Plex Under MLI Select in Halifax Worth It?

Looking at the numbers, construction realities, and market conditions, building a 4-plex under CMHC MLI Select in Halifax can be a smart investment.

The financial advantages stand out: with 95% financing and only a 5% down payment, you’re looking at leverage ratios of 20:1 compared to traditional options. This setup can deliver annual returns of 12% to 20% on your invested capital, as long as you stick to your budget and timeline. Plus, the 50-year amortization period keeps monthly mortgage payments manageable, especially with rental income ranging from $1,950 to $2,100 per unit.

However, avoiding construction mishaps is critical. The traditional approach of juggling architects, engineers, and contractors often leads to cost overruns of 30% to 60% and delays that can stretch from 8 months to 18 months. These issues not only eat into your budget but also delay rental income, potentially putting your project into the red.

An integrated design-build approach is the solution. By streamlining coordination between professionals, this method offers fixed-price certainty before construction begins. With costs locked at $200,000 per unit for MLI Select-compliant buildings and guaranteed completion in six months, you can confidently plan your cash flow from the start.

To succeed, focus on these three key factors: secure fixed-price construction to avoid budget surprises, ensure guaranteed timelines to start earning rental income as planned, and work with builders experienced in MLI Select compliance to sidestep costly delays or penalties.

When you replace fragmented construction methods with a systematic approach, MLI Select becomes one of the most promising rental property investments available today. The combination of favourable financing, strong rental demand, and energy-efficient building standards creates a solid opportunity - if you execute the project with precision.

The bottom line: It’s worth it - but only if you choose a systematic construction strategy over a fragmented one.

FAQs

What are the advantages of using an integrated design-build approach to construct a 4-plex under CMHC MLI Select in Halifax?

Using an integrated design-build approach to construct a 4-plex under CMHC MLI Select comes with several clear benefits. For starters, it provides fixed pricing and guaranteed timelines, which means fewer surprises when it comes to costs and schedules. Compared to traditional methods, this approach reduces financial risks and helps ensure your project stays on track.

Another advantage is having a single point of accountability. With one team handling everything from design to construction, you avoid the typical delays and confusion caused by miscommunication between multiple contractors. These teams use streamlined workflows and repeatable designs, making the process more efficient and helping to keep costs in check.

On top of that, the integrated design-build method is proactive in spotting and solving potential issues early. This not only saves time and money but also makes the entire construction process smoother. For property owners in Halifax aiming to get the most out of CMHC MLI Select, this approach offers a practical and efficient solution.

How does the CMHC MLI Select points system influence financing and cash flow for a 4-plex in Halifax?

The CMHC MLI Select program operates on a points system to determine the level of incentives available for financing a 4-plex, which can have a direct impact on cash flow. Points are awarded based on key factors such as affordability, energy efficiency, and accessibility. The more points a property earns, the better the benefits it can access, including reduced insurance premiums, longer amortization periods (up to 50 years), and lower interest rates.

For instance, properties with high scores could qualify for up to 95% loan-to-value financing. This makes securing funding easier and reduces upfront costs, ultimately improving cash flow and enhancing the financial viability of projects for property owners in Halifax.

What challenges should investors consider when building a 4-plex in Halifax using the CMHC MLI Select program?

Investors aiming to develop a 4-plex in Halifax through the CMHC MLI Select program might face some notable obstacles along the way.

One major issue is economic and market uncertainties, which can cause project delays. Halifax's rental market is constantly evolving, and navigating these shifts can be tricky. On top of that, the construction industry is grappling with labour shortages. This not only slows down timelines but can also drive up costs. Add to this the rising construction expenses, fuelled by increasing land prices, material costs, and the limited availability of skilled workers, and it's clear that budgets can quickly get stretched.

Another challenge is the lengthy approval processes for permits and zoning. These delays can push back project start dates significantly. Furthermore, CMHC's requirements - such as achieving lease-up to market occupancy levels and meeting bonding or other loan funding conditions - can introduce additional complexities to the process.

To navigate these hurdles, careful planning is essential. Partnering with experienced builders and professionals who understand the local market can make a big difference in keeping projects on schedule and within budget.

Related Blog Posts

- Small Multi-Unit Development 101: Building Duplexes and Fourplexes in Nova Scotia

- Convert Halifax House to 4 Apartments: ER-3 Process Guide

- 2025 Halifax Cap Rates & Construction Cost Inflation: Can Small Multi-Units Still Pencil?

- High Interest Rates, Low Construction? How the Economic Climate is Shaping Nova Scotia’s Home Builds